Rants are not worth responding but

I have known Nikhil for 10 years and have the highest respect for him, after Om Malik he is my most favourite technology journalist for his deep and incisive views. I also admire his courage to deliberate topics which are normally deemed outside the ‘overton window’ (non discussable topics)

So despite the rant I had to sit down and had to think on this because this is Nikhil asking these questions. However after reflection I found that I can’t agree with him on several counts, well this is not our first time 🙂

I also feel more compelled to do so because while he talks technology & politics in the title of his post but it seems to be a complaint against iSPIRT. And I am on the side of iSPIRT, have been part of iSPIRT from the day it officially started and many years before that. Moreover now I am a full time ‘Fellow In Residence’ since last four months running the M&A Connect program.

His rant has many factual errors including about UPI that Nikhil Kumar already points out in his tweets.

If I understand it right the following seems to be major points he rants about

- Unsettling adoption pace in Digital Identity & Payments

- Muddled debate on digital colonization

- Subversion of choice in technology diffusion

- Close relationship of technology and politics

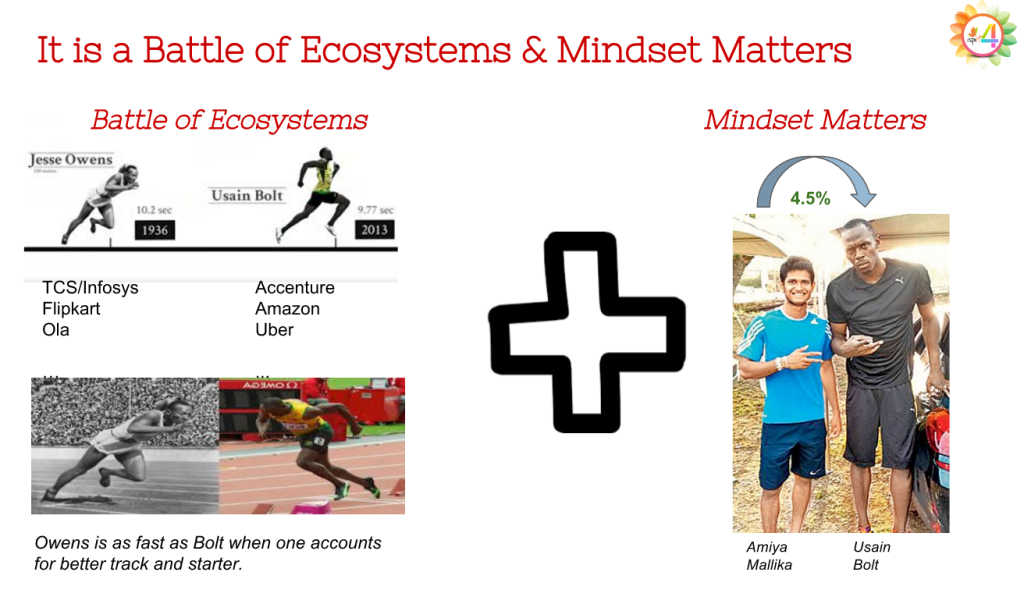

Technology is the yin, policy the yang of new markets

Technology as Kevin Kelly beautifully points out is a force of evolution, it is an unstoppable force of nature. Definition of politics or policies in this context is it is allocation of scarce resources in the face of change. Technology creates new possibilities while policies moderates those by setting up the new rules of game. Looking across time or geography this relation has been so empirical that technology and policy have been the yin and yang of new market creation.

Sometimes policies or regulation kills a market. Peer to peer music file sharing – Napster anyone ? DMCA killed it. Closer home about 5-7 years ago every mobile payment startup in India died because it was not clear who defined the policies when it came to mobile payments (RBI or TRAI)

Over time this is the reason why the ‘challengers’ just like the ‘incumbent’ have learnt to engage not only to understand the new game (technology) but to also influence the rules of the game (policies). More pronounced recent debate of defining the rules of the game for being challenger friendly is Net Neutrality of which Nikhil was the chief crusader himself.

Makes me wonder what makes one crusade(er) more noble than another.

Poor understanding of Digital colonization

Digitization is going to happen to everyone in the world, that is the force of technology. Digital or not is not the choice we have, how in the new digital world can we influence net positive societal impact is a more apt question.

I am not in favour of a state hand in speeding the process of digitization but in the digital world does one want to be in control of a private hand whom you can’t influence. I would rather prefer to yield in to the power of who I can vote out not a global private lord that dictates a feudal system.

In face of creative destruction it is indeed the responsibility of the state and the society to rehabilitate the farmer or the cobbler that loses a job because of change in technology. To shoot the messenger that warn about the creative destruction and is helping preparing everyone for the change is naive.

Dealing with Illusion of Choice

It is easy to score a debate by calling something as ‘attack on choice’. In world with natural monopolies (key digital infrastructure) options out there are merely illusion of choice. Many other countries are discovering now that Google, Facebook control identity than most countries would like to yield it. These countries have already yielded their choices and data to large corporation. Internet is fundamentally a aggregation of private data which is retailed to highest bidder. Due to India’s ability to leapfrog an architecture around data for the first time we can even enter into a dialogue about data and privacy. The debate and the policies on this has not been settled. Questions on these are great, rolling sleeves with an alternate solution even better. Standing by the side and only complaining the least useful.

Debating Issue Vs pointing fingers without facts is not cool

People in iSPIRT are rooting for positive change like Nikhil and everyone involved feels responsible for the consequence of change that takes place especially those that get influenced by them. They think deeply about the societal impact and have had major share of disagreement with the Government as well. To cherry pick links and blog post to say things iSPIRT is very close to just one stakeholder is totally unwarranted and uncool.

India stack – one of four building blocks for Product Nation

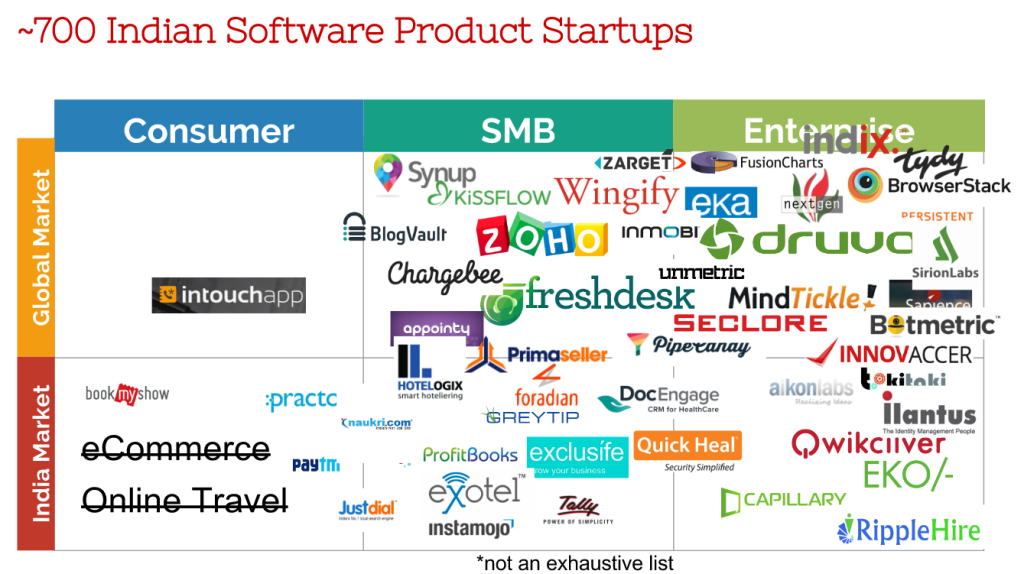

iSPIRT is a part of the ecosystem and works with everyone within it – entrepreneurs (entire spectrum of ‘new’ to ‘seasoned’ ones), policymakers, global corporates, academic researchers, developers, investors, banks, other industry bodies, global think tanks and more.

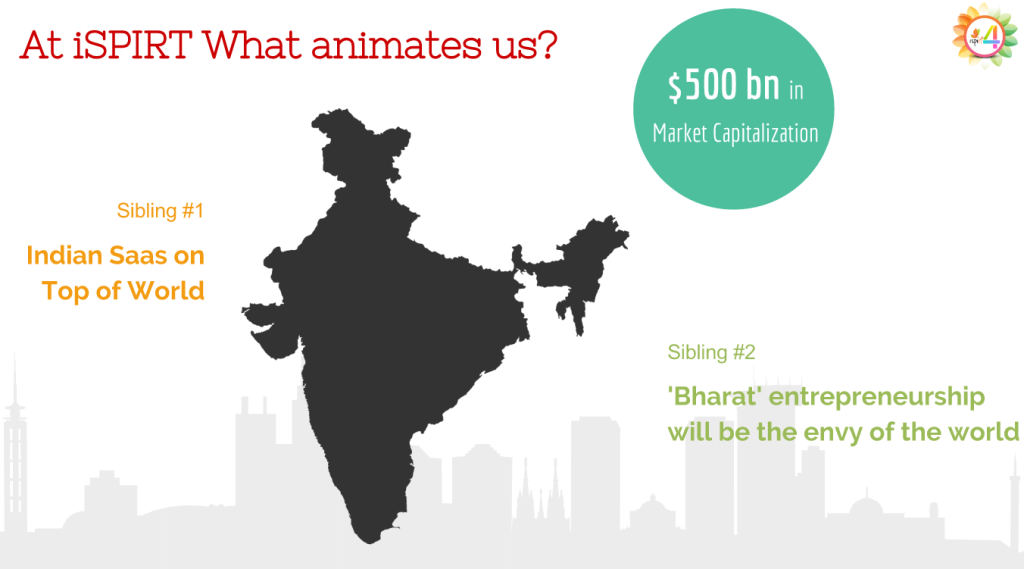

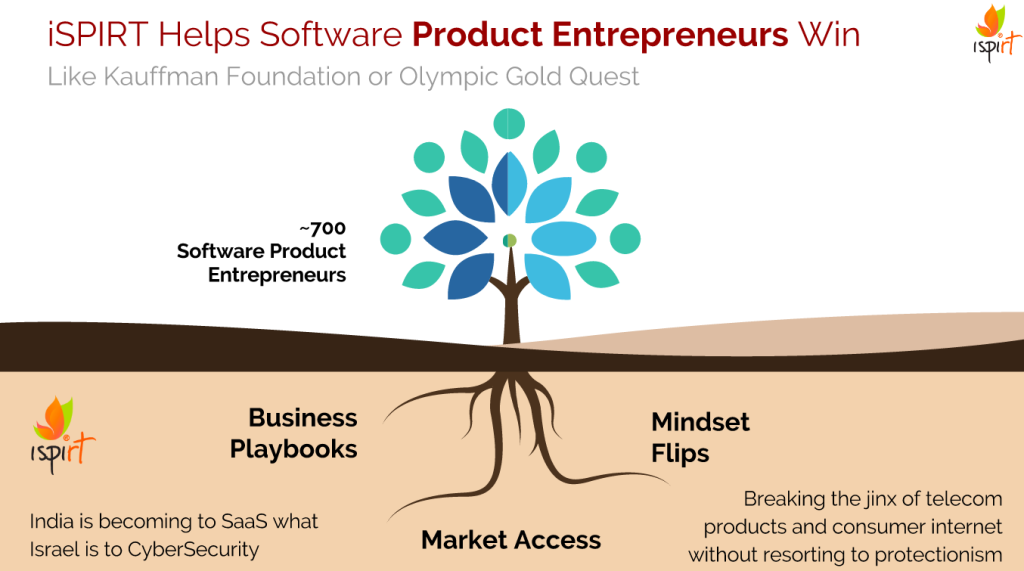

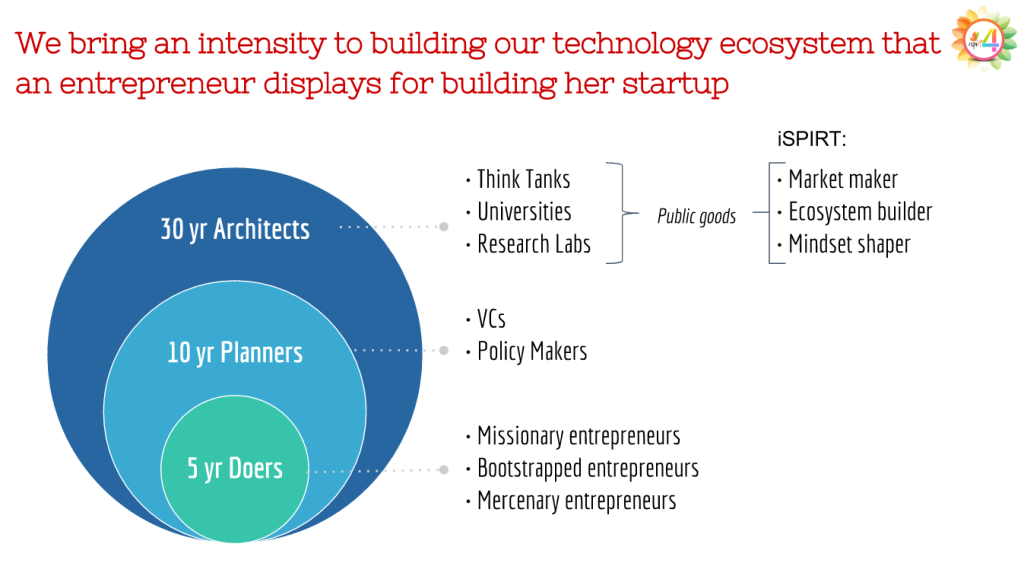

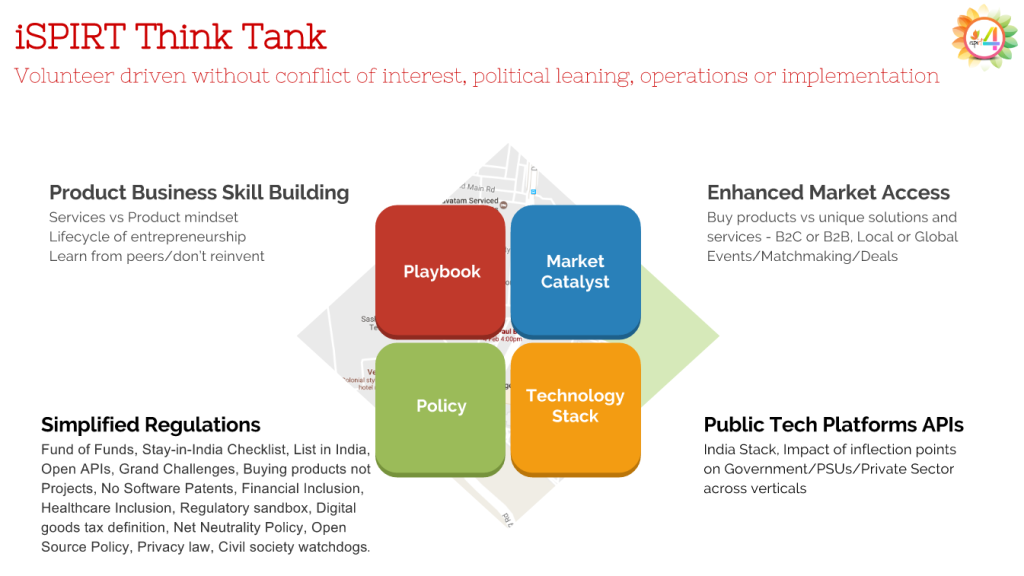

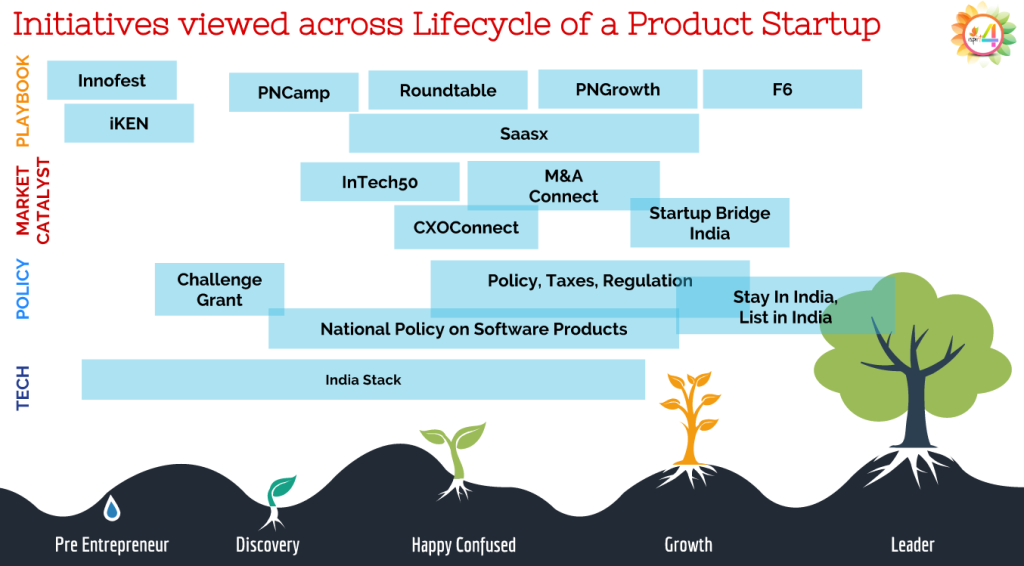

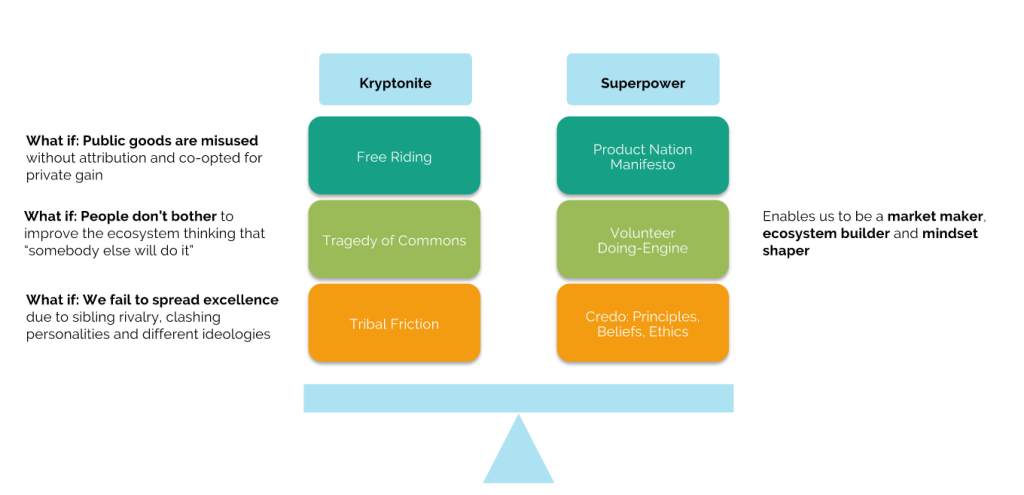

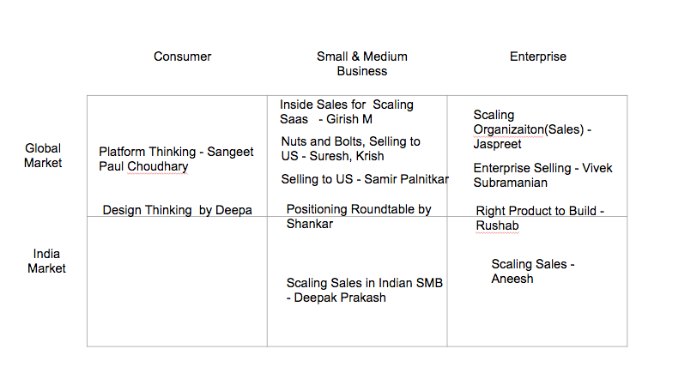

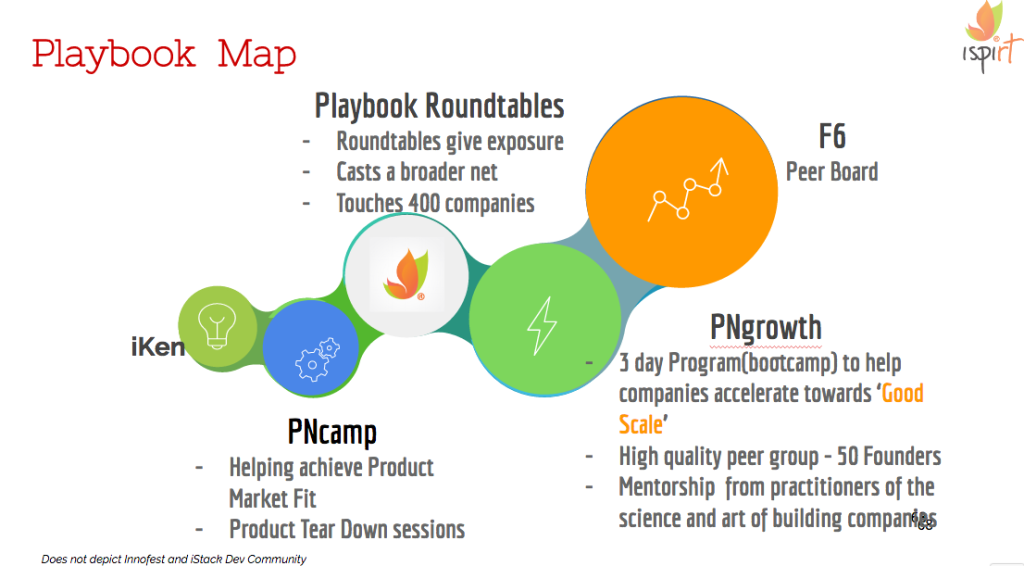

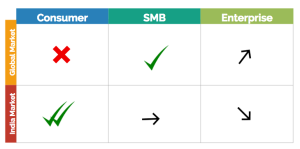

The vision for iSPIRT is building India as a Product Nation, our thoughts captured in the annual letter 2016 here. For realizing that vision building public goods is a declared motto. Four type of these building blocks of public goods is Technology (India Stack), Policy , Market Catalyst (InTech50, M&A Connect), Playbooks (Roundtable, PNGrowth, iKEN). Belief systems formalized to make this happen as credo has stood us for last four years.

As much impact as India Stack if not more is happening in other blocks as well – Innofest that is championing support of grass root innovators that will help build the ‘India 2’ (beyond metro) market. A fintech leapfrog council (FTLC) that is helping public sector banks navigate the nonlinear change, a huge step in helping banks arrest the negative impact of technology disruption. Startup Bridge India a roadshow for Indian startups in the valley declaring the arrival new global category leaders from India that silicon valley should take note of and partner. Helping grooming the next ring of category leaders in India through PNGrowth bootcamp led by practitioner entrepreneur who are few years ahead (senior doing group study for juniors). How do we know that this is creating an impact, NPS (Net Promoter Score) of each of the initiative hovers around +80.

Of course iSPIRT works with policy makers as well to ensure that when rules of game are drafted the challenger is not endowed with a structural disadvantage. When iSPIRT supported Nikhil on similar rules creating exercise with respect to Net Neutrality I do not understand why engaging other stakeholder should not be done.

Summary

I have gone through many red pill moment myself to later realize that it is also recursive, it feels smart to have the first red pill moment but is humbling when there is realization that there is a red pill’s red pill (Matrix Revolution gives a more detailed picture than just the first Matrix movie). In times of unprecedented change cognitive dissonance is bound to happen, wisdom is measured by how much cognitive dissonance one can handle.

“Nikhil, do continue to ask tough questions on important topics regardless of how discomforting they are, for we all will benefit by finding answers to it. However to attribute wrong intent to people and organization especially without facts is uncool even in a rant for you have been the gold standard of teaching India to form points of view supported with facts.

Also I would encourage you to define why should one crusade be called more noble than another one”

Think of this as group study for 7th class students in an age where there no school & teacher and one has to pass the 10th standard board exam. Some one who has done that leads the group study.

Think of this as group study for 7th class students in an age where there no school & teacher and one has to pass the 10th standard board exam. Some one who has done that leads the group study.

So here we go, the last 25. #Pngrowth 2016 is well and truly on!

So here we go, the last 25. #Pngrowth 2016 is well and truly on!