Tax on Services procured from foreign service providers

Startups and SMEs in a digital world use many services from across the world. Skype, Google ADwords and hosting services from foreign hosting providers are some examples. So also are the online services of consultants, designers, content writers and developers etc.

There is a service tax required that apply on many such services. Many people confuse on when a service tax applies or advised that there is no service tax. We also come across an opinion floating around that we can circumvent the service tax by paying using personal cards.

Yet, another confusion is on online advertisements. This got complicated further with the addition of equalization levy introduced in budget 2016-17. In some extreme cases entrepreneurs were advised that only 6% equalization levy is to paid when buying from foreign providers. So, we talked to some local consultants. And, to our dismay we found the confusions was equally prevalent among them, on equalization levy on online advertisements..

There is lot of material present on Internet on equalization levy (introduced in finance bill 2016). So, also are articles on service tax on import of service and online online advertisements. Most of these articles are in very legal language. Also, they are not presented at one place to clear the confusion for young entrepreneurs.

This article is aimed at clearing the confusions and helping small companies in understanding the issues involved, to enable them in right compliance. Let us understand the issues in following order:

- Provisions of service tax on import of service

- Service tax on online advertisement services

- Equalization levy on online advertisements

Service tax on import of services

A service tax is payable on all ‘taxable services’ in India. Present rate as on date is 15% (14% Basic, 0.5% Swatch Bharat Cess, 0.5% Krishi Layan Cess).

What are taxable services

To know if a service is taxable or not, one has to refer to provisions of Service tax act and the negative list. The negative is the list of items excluded from service tax. Usually all services that do not fall in negative list are ‘taxable services’.

The most common services that startups use are:

- Consulting or professional services – Designers, Coders etc.

- Services like Skype

- Online advertisement services (google add words/ADSense)

- Hosting or cloud services etc.

Please note that the Software is a service, unless it is physically imported on a media through a port of entry. This means the downloaded packaged Software and Software in SaaS model are ‘taxable service’. So also are other digital goods (pdfs, eBooks, music, video etc) downloaded.

Who is liable for Service tax on import of service?

Generally, the liability to pay service tax is on the ‘service provider’. Since it is an indirect tax, the service providers bills the service tax to service receiver, collects tax from service receiver and deposits it to the service tax department. However, in case of imported services it is different.

An import of service occurs when a ‘service receiver’ located in taxable territory of India receives a service from a ‘service provider’ located in nontaxable territory i.e. from outside borders of India.

Since, in case of import of service the ‘service provider’ is not located in the taxable territory of India, the responsibility of service tax lies on ‘service receiver’. This is known as reverse charge mechanism, in service tax act parlance.

The reverse charge mechanism (RCM) is applicable vide Notification No. 30/2012-ST dated 20.06.2012. This RCM notification prescribes that, “in respect of any taxable services provided or agreed to be provided by any person who is located in a nontaxable territory and received by any person located in the taxable territory”, 100% of service tax shall be payable by the person receiving the service.

This provision is not applicable in case of ‘individuals’ who have received such service other than for the purpose of use in business or commerce (Provisions made under section 66A of the Finance Act, 1994).

In view of above let use answer following two questions.

Am I liable to pay Service tax?

A business receiving services from a service provider located outside India, is liable to pay service tax at prescribed rate and as per rules in force at the time.

Can I pay from my personal credit card and get reimbursed from my company?

An individual can receive services for a consideration paid to a service provider located outside India, without a liability to pay service tax, provide the services received are not for business or commercial consumption.

This means, you should not buy services on your personal credit card and use for business. Small amounts may go unnoticed or not enforced by service tax department. But, substantial amounts of such transactions can put you in trouble at later date.

Using online advertisements from foreign suppliers

In case of online advertisements, we come across following two provisions:

- a) Service tax on online advertisement services

- b) Equalization levy on online advertisements

As mentioned above we came across some entrepreneurs confused on weather both of applies or one of them apply.

Service tax on online advertisement services

Finance act 2014 brought in changes to negative list to broaden the tax base. It now includes provision of online advertisement space on Internet as a taxable service.

Hence, a 15% tax will apply on service of advertisement.

Some people confuse on payment of service tax when they buy from companies like Google and Microsoft. At times, such companies provide some selective services from Indian subsidiary. And, they provide other services from their parent company or a subsidiary outside India.

One should be watchful on where the billing of services is being done from. If this is Google India (e.g. for ADwords), the service tax will be billed to you. The service recipient can see the service tax in the bill. E.g. Google provides Adwords from Google, India.

Many a times when you buy a service using a card online, you buy it from foreign entity. This may go unnoticed as the payment happens in Indian rupees. This happens because of real time conversion from US$ to Indian rupees by the payment gateway.

The transaction is so seamless that the buyer of service does not realize that she actually bought from a foreign company. This happens quite often in case of companies like Google and Microsoft. You buy in Indian Rupees but the transaction may be done by Google, Ireland.

You should be careful about such transactions and your liability to pay service tax. Check is the service tax is mentioned in bill as an item. If not and your billing party is foreign entity or person the service tax is your responsibility.

Special case of ADsense (or similar services)

As per common knowledge ADsense services is presently provided by Google Inc. USA. Hence, the advertisement space revenue received by the Indian websites is in US$. There is an argument that this being export of service is not subject to service tax.

The ADsense issue is not straight forward. clear. The advance ruling issued by service tax department says it is subject to Service tax. Since the agreement is between the Indian website company and Google, INC, some experts treat this as export of service. Thus not falling under service tax net.

However, there is a warning here as per service tax place of business rules. If one is able to establish the end use of service being done by an India company i.e. the advertiser is Indian company, then the situation is complex. The service tax department can call for scrutiny of cases to prove that there was not use of service by any Indian company.

So, ADsense case is not crystal clear and there is needs for caution to be exercised.

Equalization levy

The finance bill 2016 introduced an equalization levy of 6%. This is a type of withholding tax on income of non-resident (foreign service providers) from their sales in India.

The first important point to be noted here is that this is not linked to service tax at all. Service tax is an indirect tax on consumption of service, administered by service tax department. The equalization levy is a type of a direct tax levy on income and administered by Income Tax department.

What is covered under Equalization levy?

The equalization levy is applicable at a rate of 6% on the gross consideration payable for a ‘specified service’. It is applicable if the aggregate value of consideration in a year exceeds Rs. 1 lakh (approximately US$1,500). At present, the ‘specified service’ as defined in the provision are:

- Online advertisement

- Any provision for digital advertising space or any facility/service for the purpose of online advertisement

In addition, the notification also says more services can be added in future.

Who needs to comply?

As in case of service tax individual consumers are exempted. So, the levy is currently applicable only on B2B transactions.

Every resident person and foreign company (having a PE in India) is required to withhold the equalization levy when making payment to a non-resident (individual or business) service provider.

It is not applicable to non-resident service providers having a PE in India, because they will be subject to regular taxation as a PE in India e.g. Google Inc, USA having a PE in India (Google India Pvt. Ltd) is exempted from equalization levy.

Who bears the burden?

The equalization levy is designed as a withholding tax to be deducted by Indian service recipient from payments to be made to foreign service provider and deposited with Income tax department. The foreign service provider can take the tax credit in home country as per procedure.

However, there are apprehensions that some service provider will not agree to these deductions and finally the Indian companies will bear this as cost.

In any case, the responsibility to deposit the tax with Government lies with Indian service recipients.

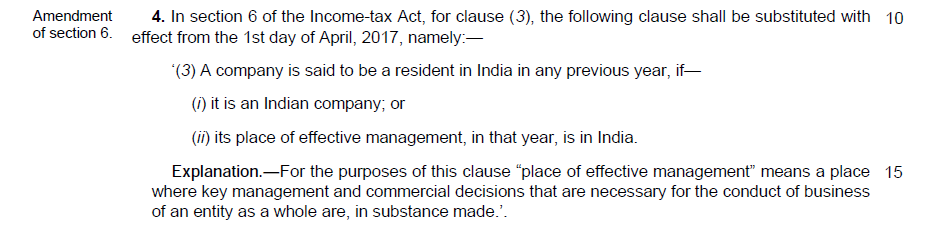

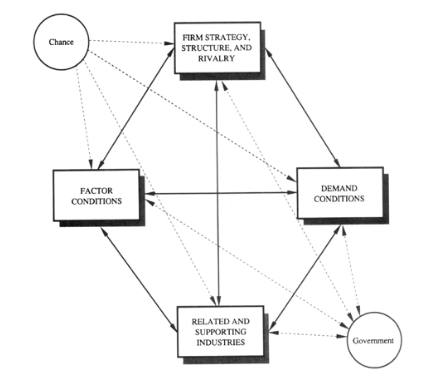

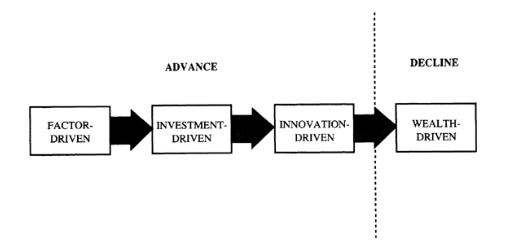

Why was equalization levy applied?

The background of equalization levy lies in a ongoing hot debate on subject of base erosion and profit shifting (BEPS) Action Plan. BESP has been under discussion at Organisation for Economic Co-operation and Development (OECD). In digital world, companies from one country can sell online across their borders without having a presence in that geography. This can cause profit erosion in these geographies across borders.

OECD does not favour proactive use of equalization levey. But, they agreed that countries could introduce one in their domestic laws as an additional safeguard against BEPS, provided they respect existing treaty obligations, or include them in their bilateral tax treaties.

It is a tax to equalize the tax burden on remote and domestic suppliers of similar goods and services in a digital world and a safe guard against BEPS.

It has been introduced in in India through Finance bill 2016, by inserting a new chapter titled Equalization Levy.

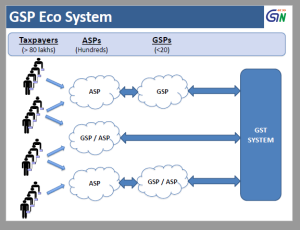

Situation in GST transition

The clarity on all aspects has still to come in GST. Yet, concepts like reverse charge mechanism (RCM) will apply. Software or all intangibles will be treated as ‘services’ as per model law. We from iSPIRT are arguing against it and wants Software products treated as ‘digital goods’. The rate of service tax will further go up. States will also be charging service tax. Hence, there will be two services tax that will be payable in GST. The state GST (SGST) and center GST (CGST).

Equalization levy has nothing to do with GST. It is going to stay and may be extended to other e-commerce in cross border trade, in future.