In the interest of transparency, here is our entire exchange with The Ken.

Our first email response to The Ken

Dear Sanjay and Siddharth,

Hope you are safe and doing well.

I’m a reporter with The Ken and I’m working on a story looking at the now pulled-back launch of Sahay on May 21 by PM Modi and the involvement of iSpirt in this project. I had some questions about the iSpirt’s roles and responsibilities with respect to Sahay and the account aggregator framework. And also examine the potential conflicts of interest it opens up. Could you help with responses by Thursday end of the day please, as this is a newsbreak.

- When did iSpirt feel the need to roll out an app like Sahay, was it always part of the account-aggregator roadmap? What have been the roles and responsibilities of iSpirt to get this off the ground?

- Who is responsible for owning and operating Sahay when it was scheduled for launch?

- We understand iSpirt is conceptualizing and designing the APIs and SDKs for this. Can you confirm?

- Why was Juspay given the mandate to make the proof of concept this time around too given that the AA framework is something that has been in the works for over 3 years. Why not let the market players come up with such an app?

- With Sahay, IDFC Bank, Axis Bank, Bajaj Finserv are among the first banks to take part, but these banks are also a financial donor to iSpirt. This raises questions on what basis banks can become part of the network. Could you explain the connection here?

- We learnt that Setu, which is run by former iSpirt volunteers has applied for an account aggregator license. Given iSpirt’s active involvement in this project, it opens up possibilities for conflicts of interest in terms of preferential treatment when it comes to choosing an iSpirt backed AA when you evangelise the concept. Please comment on that?

- Setu is funded by Sanjay Jain-founded Bharat Innovation Fund (BIF). By virtue of being an iSpirt member, Jain’s visibility and roadmap of iSpirt’s projects allow funds like the BIF to back the right horses. This again brings up questions of conflict of interest. Can you comment on this, please?

Thanks in advance.

Dear Arundhati,

Thank you for reaching out to us.

To help you understand iSpirt’s roles and responsibilities with respect to Sahay and the account aggregator framework and to equip you to examine potential conflicts of interest you think it opens up, let me first explain the iSPIRT model as described here: iSPIRT Playgrounds coda. This document sets context for our answers, and many of your questions can be answered by referencing this code. It lays out in detail iSPIRT’s design for working on hard societal problems of India and how we engage with the market and the government actors in that journey.

Now to answer your questions:

1. When did iSpirt feel the need to roll out an app like Sahay, was it always part of the account-aggregator roadmap? What have been the roles and responsibilities of iSpirt to get this off the ground?.

The idea behind Project Sahay is nearly as old as iSPIRT itself. This is one of our earliest depictions of the idea of a credit marketplace from 2015 on the left. Over time this idea was more popularly encapsulated in the “Rajni” use case depicted on the right. Despite our evangelism, in the 6 years since this slide was made, no market player has built something like Sahay (Referring to your Q4 here).

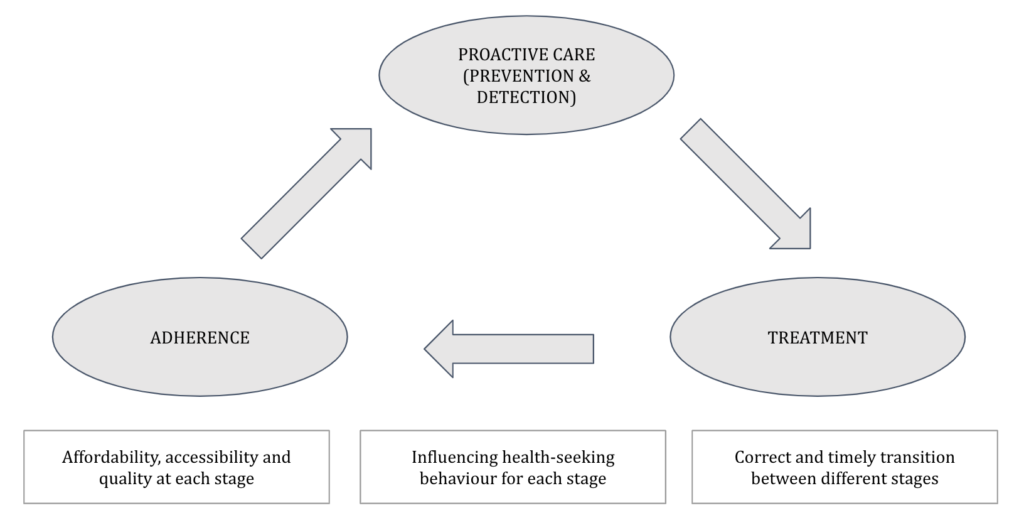

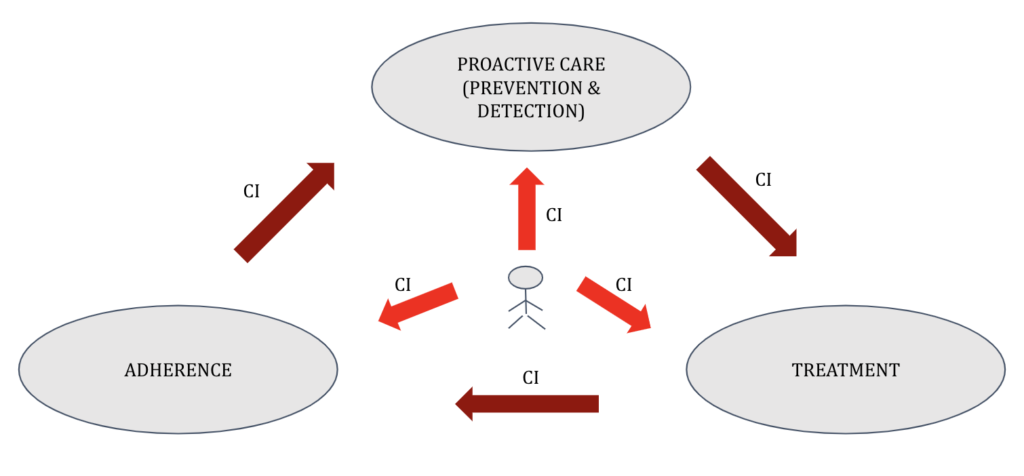

When the economic slowdown hit in August of last year, our conviction was that the need for cash flow lending was urgent. Since a credit marketplace needs many moving parts to work well, it would require many market and government participants to accelerate their plans as well. The UK Sinha Committee on MSMEs had done the important groundwork of laying out the basic architecture of what needed to be done.

Technical documents like API specs do not capture people’s imaginations. In our experience, the simplest and quickest way to unlock the imaginations of market participants and current and potential future entrepreneurs is to build an operational implementation and highlight its capabilities.

We have encouraged building of operational implementations in the past as well. Sometimes we build it with our partners (e.g. Credit Marketplaces), sometimes market participants do (as showcased on 25th July 2019 for Account Aggregators by Sahamati), sometimes government partners do (as NPCI did with UPI).

To this end we chose the temporary working title for an ongoing initiative “Sahay” and gave it a realistic but ambitious deadline of May 21st. The outcome of Project Sahay, was not one app, as you have assumed, but to catalyse several credit marketplaces to come up to help MSMEs access formal credit. We do not see this reflecting in any of your questions.

Many players who did not opt in to be market partners with iSPIRT (reference 4.b “On market partners”) would opt in once they see the Wave 1 markeplace implementations in operation. We call this Wave 2, and have a model to support them as well.

2. Who is responsible for owning and operating Sahay when it was scheduled for launch?

At iSPIRT, we try to imagine a future and work backwards from there. Project Sahay helped develop early adopters of an ecosystem to come together in a coordinated way.

For cash flow lending, we needed many marketplace implementations. Each marketplace needs multiple lenders to encourage competition and not give any one player a significant head start. Unlike, say BHIM (the reference app for UPI) this marketplace needs much more groundwork and plumbing to come together in time. We used Project Sahay as a forcing function towards this aim.

Project Sahay was about many marketplace implementations. One of them would have been adopted by government partners like NPCI or PSB59. However, the marketplace implementations are still under development. So this question is premature.

Post COVID19, our view is that Cash Flow based lending as an idea itself may get pushed out by a quarter or two in the market, so our efforts on Project Sahay, will also get pushed out. We recently posted a blog (COVID19 strikes cash flow lending for small businesses in the country) about this.

3. We understand iSpirt is conceptualizing and designing the APIs and SDKs for this. Can you confirm?

In regards to the Account Aggregator component of Project Sahay, the specifications for Financial Information Providers, Financial Information Users, and Accounts Aggregators have been designed & published by ReBIT and are publicly available here: https://api.rebit.org.in/ It was notified by RBI on November 8th 2019: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11729&Mode=0

In regards to the design of the APIs & SDKs for the credit marketplace component of Project Sahay, please refer to our iSPIRT Playgrounds Code (Reference 4b. “Market Partners”).

4. Why was Juspay given the mandate to make the proof of concept this time around too given that the AA framework is something that has been in the works for over 3 years. Why not let the market players come up with such an app?

Refer Q1, no market player had built this in 6 years.

JusPay is an active market participant in this ecosystem. They volunteered to build an open-source implementation so that many marketplaces can come up quickly. We saw no conflict, in fact we appreciate this gesture on their part to open-source.

We see the framing here includes “this time around too”. If by this you mean BHIM for UPI, that was entirely a NPCI decision. We do not advise on procurement. (reference 4.c “On government partners”)

The AA framework and thinking has been around for 3 years. Sahamati (https://sahamati.org.in/) is a collective for the AA ecosystem. All the required resources to guide new AAs to develop are available at Sahamati website.

5. With Sahay, IDFC Bank, Axis Bank, Bajaj Finserv are among the first banks to take part, but these banks are also a financial donor to iSpirt. This raises questions on what basis banks can become part of the network. Could you explain the connection here?

We want to answer your question at two levels. First, your question implies pay-for-play. We want to categorically deny this. Please understand our donor model first. (reference 5. “How does iSPIRT make money”)

Any allegation of pay-for-play is baseless. We engage with many more market partners who are NOT donors than donors who are market players. Their donor relationship and “market partner” relationship with us are independent.

Second, in case your question here is procedural on “how can banks become part of this network”, as defined in RBI’s Master Directive of Account Aggregator:

- Clause 3 (1) xi – any bank, banking company, non-banking financial company, asset management company, depository, depository participant, insurance company, insurance repository, pension fund and such other entity as may be identified by the RBI for the purposes of these directions may become a Financial Information Provider (FIP).

- Clause 3 (1) xii – Any entity that’s registered with and regulated by any financial sector regulator can become a Financial Information User.

- Clause 3 (1) x – “Financial Sector regulator” refers to the Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory and Development Authority and Pension Fund Regulatory and Development Authority

Here’s a link to the FAQ on Sahamati website for you https://sahamati.org.in/faq/ that explains this deeper.

On July 25th last year, Sahamati was launched with 5 early adopter banks who had conducted proof of concept of the Account Aggregator network. Please see here for media coverage.

6. We learnt that Setu, which is run by former iSpirt volunteers has applied for an account aggregator license. Given iSpirt’s active involvement in this project, it opens up possibilities for conflicts of interest in terms of preferential treatment when it comes to choosing an iSpirt backed AA when you evangelise the concept. Please comment on that?

We object to use of the term “iSPIRT backed” in relation to Setu. We ‘back’ every startup that seeks to build for India. iSPIRT has no financial interests in any of these companies. Setu does not enjoy any special status.

A note on your reporting: I recommend revisiting your phrasing here and ensure you substantiate the claims you make. Our volunteers are employees of many startups and large institutions in the country. We knew this reality and designed governance structures accordingly

Please refer to our model and feel free to report on when we have departed from our stated model. Please avoid sensationalising our regular course of work, by cherry-picking two volunteers and attempting only a tenuous link.

iSPIRT enjoys the confidence of many of its market partners and government partners only because we take a ‘non interested party’ stance to all our work. We are committed to staying this way. It is an existential threat if we do not live up to this principle. So we take these allegations extremely seriously.

Therefore, if you’re going to imply we gave any preferential treatment, I hope you and your editors realise you carry the burden of proof on this allegation. We also believe that sunlight is the best disinfectant. Hence, we do not want to stop you from doing your job, we welcome the criticism. However, in exchange, we request you meet the highest standards and have credible evidence on any allegations or even insinuations you make about us.

7. Setu is funded by Sanjay Jain-founded Bharat Innovation Fund (BIF). By virtue of being an iSpirt member, Jain’s visibility and roadmap of iSpirt’s projects allow funds like the BIF to back the right horses. This again brings up questions of conflict of interest. Can you comment on this, please?

We have described our conflict of interest model in the iSPIRT playgrounds code (Reference 6. “How does iSPIRT protect against conflict of interest”?)

To back the right horses, VCs are meant to be on top of trends. Sanjay Jain is not on top of trends because he was a volunteer at iSPIRT Foundation. iSPIRT is on top of trends because Sanjay Jain is a volunteer. We would ask you to look at his history of work, his thoughtful and original comments on many forums (which often diverge from the iSPIRT view, specially in the last 3 years since he has transitioned into becoming a full-time VC)

Think Tanks like us put out bold visions for the country, and Sanjay Jain is not the only VC who keeps an eye on our activity. We often even invite VCs for sessions and encourage them to back all players without recommending any specific one. Most often the locus of this engagement is the public sessions we hold. Some examples:

- 2015: Whatsapp moment of India. Nandan Nilekani presentation on the future of finance and many articles written about it

- Startup India Launch – Jan 2016 13th. India Stack unveiled as part of official program of Digital India (Public event)

- Cash Flow Lending – DEPA launch 2017 August – Nandan Nilekani and Siddharth Shetty Presentation at Carnegie India event

- Public Presentations by Pramod Varma, Sharad Sharma, Nikhil Kumar on India Stack

- Siddharth Shetty explaining AA at an event at @WeWork Bangalore

- 2019 Sahamati Launch with a presentation by Nandan Nilekani and representatives from MeiTY, SEBI, multiple Bank CEOs, and AA entrepreneurs.

- Sahamati conducts multiple public workshops on the AA ecosystem as published on its website and twitter accounts.

All the Setu founders who were iSPIRT volunteers and Sanjay Jain have been subject to the prescribed process for managing conflict of interest. We stand by this and ask you once again to demonstrate greater proof than simply Sanjay Jain was once a volunteer, and is now a VC.

We want to add some more perspective on the people & organisations you’ve named:

Sanjay Jain is a beloved volunteer at iSPIRT who we think is one of the best design thinkers in the country. When he moved to BIF, iSPIRT’s Volunteer Fellows Council designed him and his activity within iSPIRT to be conflict-free. He therefore does not participate in any of the Sahay related work.

JusPay is a supremely talented engineering company with a strong “build for India” bias. They have been market players who embrace some of our big ideas and have demonstrated willingness to pay-it-forward. We are ready to work with any such actors who share our commitment and mission towards solving for Rajni.

Setu and many other startups like them all have a grand vision for India and these are the very private innovators we help co-create public infrastructure for. The more of these there are, and the better they and their competitors innovate, India and Rajni ultimately gain.

We trust this response gives you ample context to review and assess your allegations of conflicts of interest. You have not reached out once to clarify our plans or ambitions, except this questionnaire 30 hours before your deadline. We have answered these questions even in this aggressive timeline. A more frank and open discussion could have been easily arranged if you had reached out to us earlier, rather than at the end. Given the framing of your questions, and the tight response time you offered us, we can no longer brush this aside as simple oversight.

Your questions frame all iSPIRT engagements with the govt. and market players as potential conflicts of interest. It takes the very essence of what we do – help co-create public infrastructure for private innovation – and attempts to cast a doubtful light on it. To protect ourselves from being misquoted, we intend to publish this email exchange on our blog so people may see the whole exchange in context and decide for themselves.

Our second email response to the The Ken.

Sources allege that when iSpirt was involved in designing the APIs and SDKs for Sahay, there were no inputs taken from the market participants.

Please refer to Q3 of your previous email. iSPIRT’s code of coordination with market participants is available here: Reference 4b. “Market Partners”)

Please understand that we first announce our vision in public. Then we co-create with partners who express conviction at an early stage. We call them early adopters or Wave 1. We work with them and iterate till we surface an MVP for wider review. At this point, the path to go live is clear, as is the ‘ownership'(reference your question #2), and it invariably involves a public review phase. After Wave 1, we work with Wave 2 participants as well for scaling adoption.

The mental model you should have for iSPIRT Vision/Wave 1/ Wave 2 is those of Alpha/closed Beta/Public beta in the technology world. This is not an uncommon practice.

I can tell you that I have personally been in multiple feedback sessions on the APIs with Wave 1 market participants. It constitutes a large part of my work. Therefore, I can categorically deny these allegations. I can understand the confusion if your sources are not from Wave 1. They are open to participate in Wave 2. Before you allege that our process is not collaborative, please clarify with your source if they are confused about Wave 1/Wave 2.

Also once iSPIRT hands over the tech platform to the operating units, who guarantees end-use limitation of data, and who is accountable for breaches? Who answers to the Data Protection Authority when it eventually comes up? Also, who will end up owning Sahay?

There will be many marketplace implementations each using common APIs and building blocks. Some of these standards will be de-jure standards (like Account Aggregators). Others, like between Banks and marketplaces will be de-facto standards. Page 125 of the UK Sinha MSME Committee Report provides details of this. Please consult this and feel free to ask further questions.

Please reach out to me at [email protected] for any questions.