Think about endgame, chess grandmasters do so to win.

Studies point out that chess grandmasters visualize the chess board state few steps away to a ‘winning game’ and make moves based on memory pattern that can lead to that board state and thus help them win the game.

Many startups however operate in a game where the rules are dynamic and change unexpectedly. An unanticipated flood of competition could sweep in, or the ground gets shaken underneath because of a regulation or policy change. Due to such unpredictability most of the founder’s move is extremely tactical, the focus is in on surviving and not getting killed as opposed to planning to grow like rabbits.

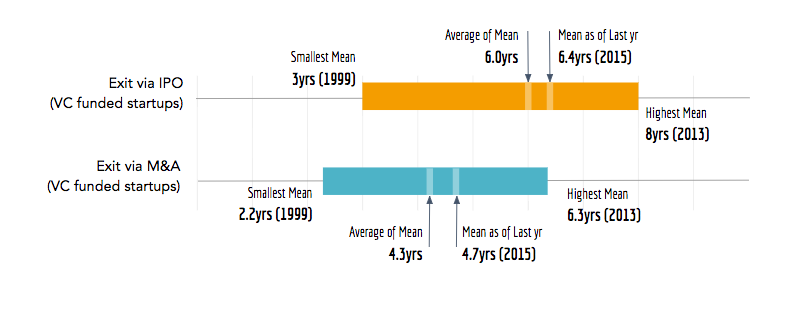

Data from 20 years of startups in US suggest mean time to exit is 4th and 6th year.

This is simply because If investors don’t do that then they can’t return the capital to their own investors (i.e limited partners) within the 10 year fund cycle.

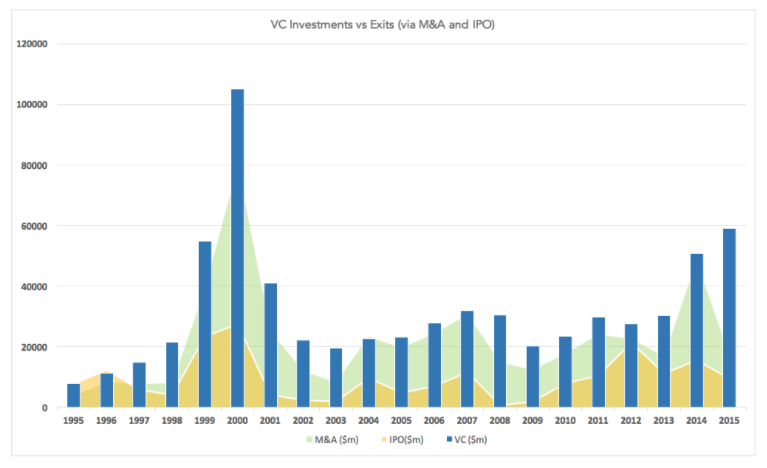

Same data also reveals that after 1997 there has been more exit through M&A than IPO both in terms of count and value which means that it is more likely for a startup to have an exit via M&A rather than an IPO as the most likely route

In India with no IPO route, M&A is the most likely endgame

On decade long VC scale, Indian ecosystem is quite young and thus historical data is not available to compare however similar forces broady apply.

Also while scale can become large but technology market growth rates in India are not as fast the US. Add to this the fact there is no IPO market in India for the technology companies. Some efforts are underway to open it such as the new ITP platform by SEBI but nothing has kicked in practice. That makes M&A option all the more important to consider for an Indian startup founder.

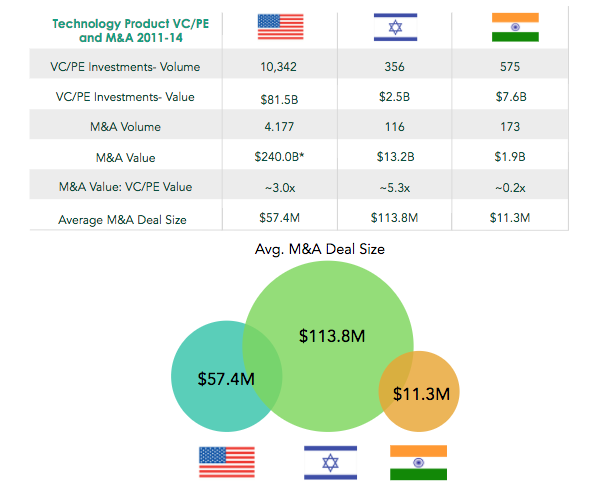

From limited data that is available about the Indian ecosystem we can that $14.5 billion of VC money has been invested in last 4 years and $2.5b of exits have happened in the same period spread over 300 deals. This ratio are still very skewed when compared to other ecosystem.

All of this build the strong case for why an Indian startup founder should think about exits via M&A

A reason they don’t think about it is because they don’t know much about exits or the playbook involved in doing that. Second likely reason could be that advisors actively discourage founders from thinking about exits by labeling them opportunistic and not being a visionary founder.

Paradoxically the right time to think about exits is exactly when an exit is not needed.

Founders should think about exit before they are forced to think about it

PS: Exit has a broader significance, applies to open source and even countries. Here is a talk by Balaji Srinivasan that illustrates the importance of exit as key lever of an healthy ecosystem

This is an interesting topic for dialogue. Need a deeper discussion and understanding to get to the root cause of the problem.

1. On the one on hand we brainstorm about why there is not Google and Facebook in India? Why there is no billion dollar product companies in India? and so on. On the other hand we criticize founders for not selling their companies.

I like to know how many of the Indian companies (173) are acquired by an another Indian company? What percentage of it is acquired for foreign companies?

2. 40% of the US companies got acquired. 30% of Indian companies and 30% of Israeli companies got acquired. The difference in terms of number of companies got acquired is not much. But look at the $$$. In the US, M&A volume is 3 times (300%) the total investment. In Israel it is 5.5 times (550%). Look at what has happened in India. It is just 20% of the total investment. In the case of India, it looks like selling the leftovers. Do you expect other companies to agree for this kind of cheap deals?

Let me know if am reading the number wrong. Where is the shyness here? If there is a good opportunity, many of the Indian companies will sell it off to foreign companies. Look at what is going on in the FMCG sectors. Almost all companies are eaten by Pepsi and Nestle kind of monsters. Only companies like “Kallimark” are surviving as Made in India companies.

My Personal Opinion:

I love to see companies like Zoho, TATA and Kallimark in India. Acquisitions by foreign companies is good in the short-term. If this is the trend, then it is like selling out the Nation. In the long-term, we need more companies like Zoho to drive the M&A in India. In the short term, we need small technologies to persevere, drive more value and then decide whether they need to continue in the same path or look for buyers locally.

In the long-term, we need more companies like TATA to go out acquire companies in the foreign land. Otherwise, “Made in India” and “Make in India” movement will just be an illusion or day dream.

If there is an absolute necessity to sell a company, then they need to get good deal. I hope companies in India deliver more value and have patience for long-term gain.

Let us leave to individual founders on what they should be doing…

THIYAGARAJAN M’s article is most insightful. Thank you.Just two points to add. One, startups should try to exit in a bull market. Secondly, founders can take the proceeds of M&A and start other businesses and become serial entrepreneurs. In such a scenario, there is no endgame.You always remain an entrepreneur.