Recently was having a conversation with a Private Equity friend and was trying to explain the challenge that has captured my imagination and full attention, ie exits for software product startups in India. He felt that the data about the exit structural deficit that I was trying to point out felt too bearish to be true. My counter argument was that my intent is not to sound bearish but instead be a realist, after all acknowledgement of a problem is first step to solving one. Post that conversation I thought should put this data out publicly so that through crowdsourcing can at the very least improve my understanding if it is off by wide margins.

India VC vs Exits

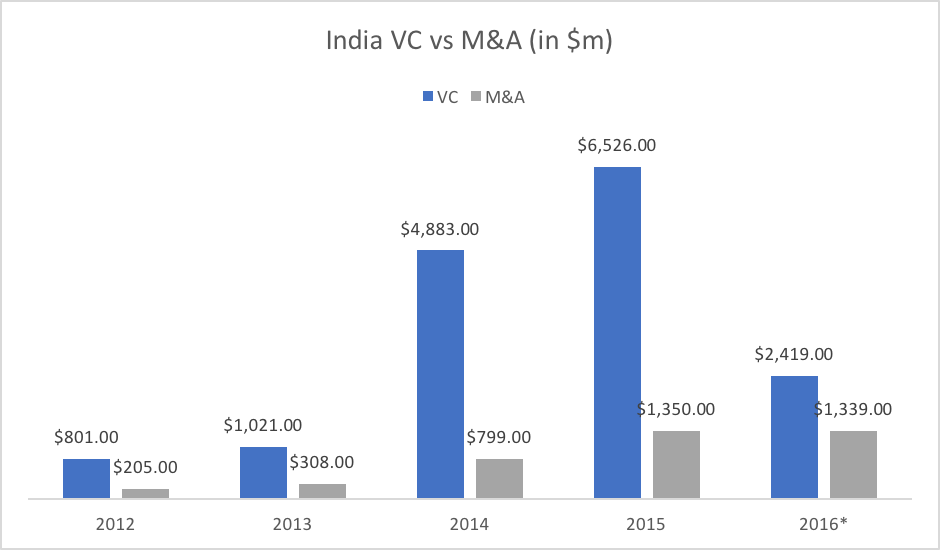

India Software Products VC (in $m)

| 2012 | 2013 | 2014 | 2015 | 2016* | |

| $801.00 | $1,021.00 | $4,883.00 | $6,526.00 | $2,419.00 | $15,650.00 |

| 147 | 123 | 173 | 330 | 223 | 996 |

India Software Product M&A (in $m)

| 2012 | 2013 | 2014 | 2015 | 2016* | |

| $205.00 | $308.00 | $799.00 | $1,350.00 | $1,339.00 | $4,001.00 |

| 43 | 39 | 59 | 137 | 113 | 391 |

Source iSPIRT M&A Report https://www.slideshare.net/ProductNation/india-technology-product-ma-industry-monitor-an-ispirt-signalhill-report?ref=http://startupbridgeindia.com/

Israel VC vs Exits

Israel Software Product VC (in $m)

| 2012 | 2013 | 2014 | 2015 | 2016* | |

| $1,878.00 | $2,404.00 | $3,422.00 | $4,307.00 | $4,775.00 | $16,786.00 |

| 567 | 667 | 684 | 706 | 659 | 3283 |

Israel Software Product M&A (in $m)

| 2012 | 2013 | 2014 | 2015 | 2016* | |

| $8,149.00 | $3,704.00 | $4,493.00 | $6,462.00 | $6,782.00 | $29,590.00 |

| 74 | 81 | 109 | 98 | 86 | 448 |

Source IVC Report, http://www.ivc-online.com/Portals/0/RC/Survey/IVC_Q4-16%20Capital%20Raising_Survey-Final.pdf

Above data indicates that Israel was able to generate 1.8X of the money that went in while in India in the same period it was 0.2X. The right comparison is exits from 2012-2016 with VC investments from 2005-2009, iSPIRT report does that comparison but results are even less encouraging.

Exits follow a power law distribution, however in India it seems like a power law’s power law.

Not only is the volume of exit a challenge but also the structure, any ecosystem exits follow a typical power law. For every $1 bn exit, there are ten $100m deal, for every $100m there are hundred $10m deals.

Top 7 deals in India account for ~$2.5b of the $4b in exit. About 250 of 391 deals total a deal volume of $97m which means the size of an acqui hire i.e in long tail is about 0.5m, which is inadequate even for an angel investor (in other ecosystem long tail is >$10 m, hence being referred to as power’s law power law). Lack of many $10-100m deal means there is a missing middle of the long tail.

Source iSPIRT M&A Report https://www.slideshare.net/ProductNation/india-technology-product-ma-industry-monitor-an-ispirt-signalhill-report?ref=http://startupbridgeindia.com/

Anything in the data above that does not feel kosher ?

iSPIRT M&A Connect program takes a multiyear view to design interventions that can address the middle and long tail of the market coordination challenge.