Playbook in iSPIRT denotes entrepreneurial learning meant for Indian software product startups to become world class and be successful.

Roundtable is a format of learning intended for startups that have reached a happy confused stage. In this format 8-12 non competing startups are brought together to discuss deeply on a topic that holds them from jumping to their next level.A facilitator, who is an in the saddle entrepreneur deep dives on the topic by becoming metaphorically naked and shares his experience and gets a peer discussion going on the topic.Coaching including peer coaching happens through multiple mode – judgement of the discussion (VC mode), sharing experience (Sage on Stage), being a mirror (Guide by the Side). Playbook Roundtable tend to be more of the last category of mirroring.

Think of this as group study for 7th class students in an age where there no school & teacher and one has to pass the 10th standard board exam. Some one who has done that leads the group study.

Think of this as group study for 7th class students in an age where there no school & teacher and one has to pass the 10th standard board exam. Some one who has done that leads the group study.

Playbooks have a longitudinal impact so they are tracked via an input metric. At the end of every roundtable session a Net Promoter Score (NPS) is calculated via survey, the average NPS score of last 85 roundtable that were held is about +80. (iPhone as a product has an NPS of +71).

Roundtable was initially architected by Shankar Maruwada, Ashish Gupta, Vivek Subramanian & Aneesh Reddy. Some learnings from past roundtable are captured here

Key organizing principles behind creating playbook roundtables

- In the saddle entrepreneurs are the best to teach upcoming ones. Age, company brand plays no role.

- Quality > Quantity which means traditional format of 1 to 100 classroom style and metric of footfall attendance should be questioned.

- Safe environment are absolutely necessary to have deep discussion.

- Curation is highly important, ie. have non competing participants and bring people together in similar stage of startup growth.

- A facilitator and organizer checklist.

I have had the privilege to shadow about 40 of 85 roundtables that have happened in last 3 years. If I describe it as saying that gold dust of the tacit knowledge gets shared it won’t be an exaggeration. Chatham rules apply in a roundtable i.e. to protect the safe environment no quote is attributed to a person. However this deck those captures some of the discussed tacit knowledge as directives

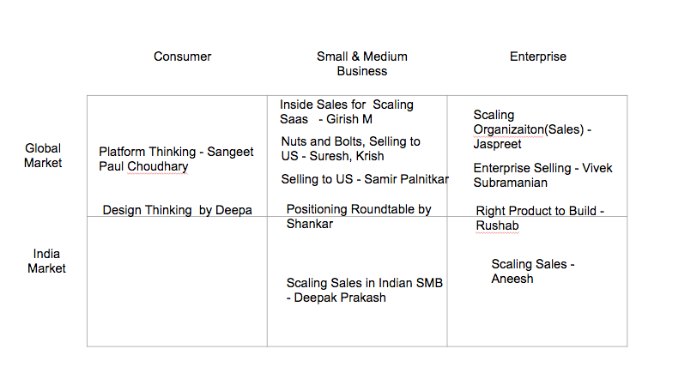

A good mental model to decide which roundtables can be used from the market map

Check details at the events section in PN blog

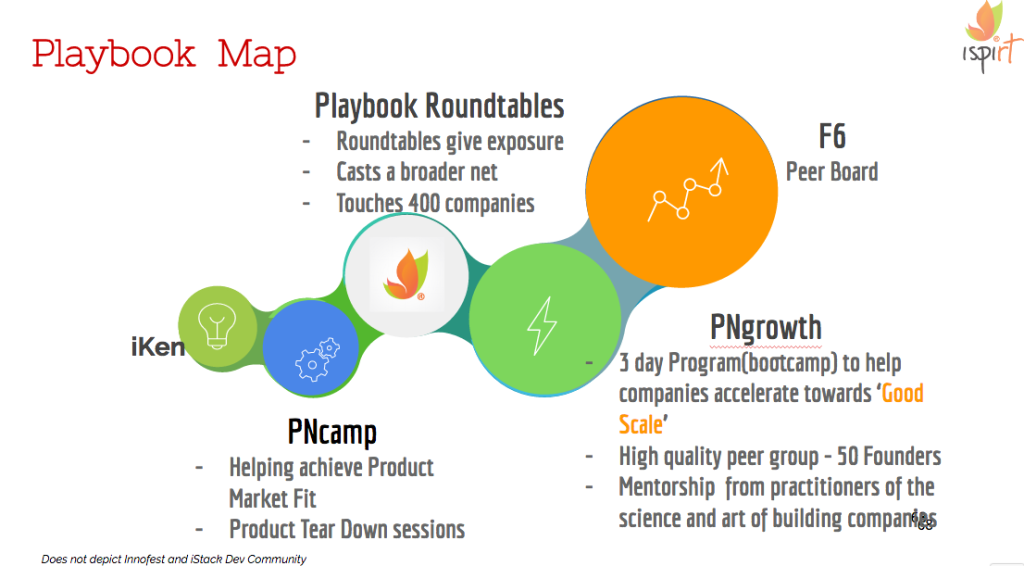

Playbooks is more than roundtable

The initial focus of Roundtable was happy confused product startup founders a later realization was that playbooks will need to extend across the spectrum of entreprenuership lifecycle.

kindergarden > discovery (1st to 7th std) > happy confused (7th std) > pre-scale (10th std) > pre-growth(pre college)

Some of these additional formats emerged

- Kindergarten

- Discovery

- Happy Confused

- Pre-scale

Playbooks sets down one of the most critical foundation layer for India to be product nation.

Last Friday, I hosted the M&A Panel at

Last Friday, I hosted the M&A Panel at