OCEN is an initiative to unbundle lending and enable the creation of specialized entities, each specialized at one part of the job. Therefore, we envision the future of lending to be a partnership between multiple firms individually focused on sourcing/distribution, identity verification, underwriting, capital arrangement, recollections, etc. The entities like marketplaces who have high business-connect with their customers (businesses or individuals), can embed credit offerings in their applications now. These entities are referred to as Loan Agents’ (LAs) and were previously referred to as ‘Loan Service Providers’ (LSPs).

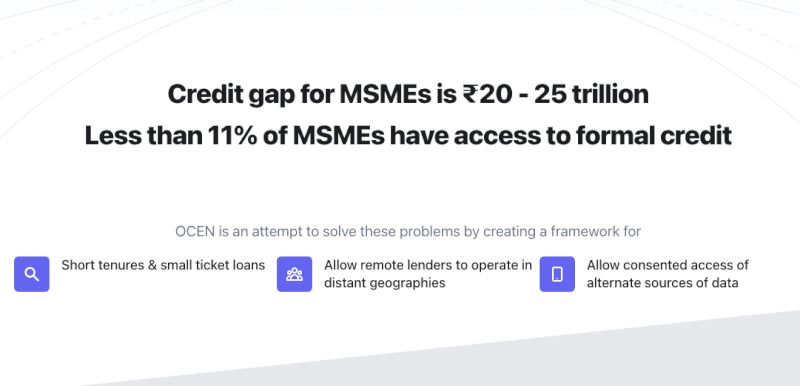

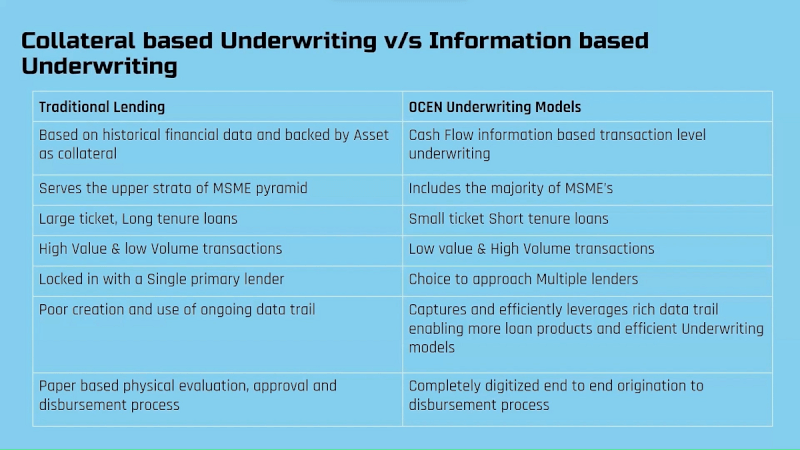

OCEN (Open Credit Enablement Network) aims at democratising the lending ecosystem. The core philosophy is using open networks to reach out to maximum borrowers and lenders, with reduced risk, more transparency, strict control on funds (both end use & collections) and thus building a robust lending ecosystem. At the borrower level, using consent driven architecture and personal data as information collateral, any type of borrower (even new to credit or people with poor credit scores), can access financing. The end-to-end digital processes not only reduces the total cost of operations, but also has the advantage of reaching out to anyone and everywhere, without the lender having a physical presence. For example, sitting out of Jaipur, a NBFC has disbursed OCEN loan on GeM Sahay to borrowers operating from Andaman Nicobar Islands, Manipur, Baramullah etc and the smallest loan transaction has been of Rs.160 for business purposes.

OCEN is the right protocol, to bring credit/finance to the bottom of the pyramid and at the same time lenders also make money with this same section of people at the bottom of the pyramid. OCEN not only levels the playing field between incumbents and challengers, but also reduces the concentration risk which comes with size at bigger players. Most MSMEs are working capital intensive businesses that need quick money and do not have collateral securities to put up to banks for conventional Cash Credit limits like financing. For such businesses, this is a tool to grow their businesses, and improve their credit scores.

Lenders see opportunities in not only sourcing new business, but also reduced risk due to high quality data and use of DPI (Digital Pubic Infrastructure), like GSTN, Account Aggregator, Digilocker and its associated APIs, like mobility, Health, Fastag etc.

Why OCEN

Low Cost of Acquisition >> The Borrower Agent brings his borrowers on the network, reducing the cost of acquisition through various channels. OCEN framework benefits the Lenders to gain easy access to borrowers. Not just borrowers of one network, but easy access to multiple sets of borrowers of multiple networks.

Lower Cost of Underwriting >> The Borrower Agent also acts as a Provider of Derived Data along with other Underwriting data from various sources like GSTN and Account Aggregator which helps in lowering the Cost of Underwriting

Digitisation >> OCEN Digitises the whole process which involves various activities like Bureau pull, KYC validation, Account Aggregator data, E-Sign on documentation, e-NACH for repayment etc and reduces the time and effort of processing at reduced costs.

Reduced Cost of Collections >> OCEN provides a large opportunity to Lenders and Borrowers to participate in T4 (Type 4) loan products which have End Use Control and Collections control for ensuring higher portfolio quality and cash flow control as well as reduced Cost of collections

OCEN solves for MSME’s Credit requirements: Small Ticket Short Tenure Loan

Small businesses need loans of smaller amounts and for shorter tenures (15/30/90 days) for their businesses compared to larger businesses to help them navigate through the requirement of day-to-day Working Capital needs.

It also helps Lenders to create Loan books for smaller loans which are granular loan exposure on a rotational basis, compared to large bulky loans. Hence reducing concentration risk.

As these Loans are for short tenure, there is higher predictability and lower risk compared to long tenure loans in which recovery of loans may sometimes be a challenge.

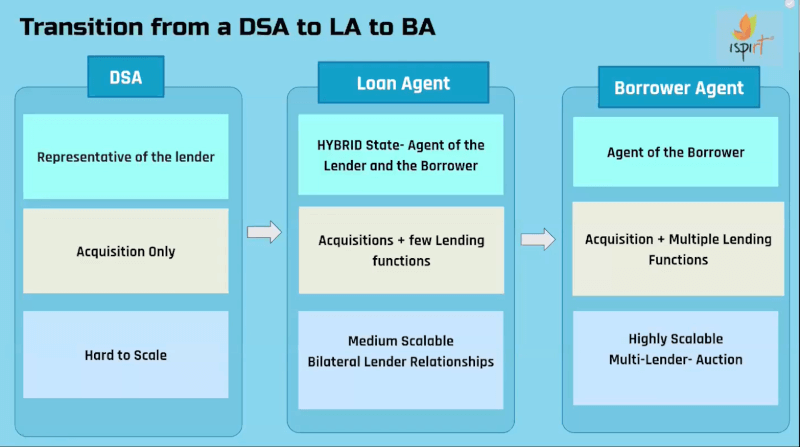

Loan Agent model

The Loan Agent (LA) model is a departure from the Direct Sourcing Agent (DSA) model and is an ‘agent of the borrower’. The LA explains to borrowers their ‘bill of rights’ ensuring transparency and safeguarding of borrower interests. They educate the borrowers about the various credit product offerings, pricing and more details. They help the borrowers get access to formal, affordable credit at low interest rates and collaborates with lenders to create more tailored offerings for borrowers.

In their simplest form, LAs are a loan marketplace that enables borrowers to compare loan offers from multiple lenders and choose the best one. In a more advanced version, the LAs are akin to a borrower’s financial advisor, looking after their interests, fetching the best offers and advising the customer to make good decisions.

In the longer run, it is envisioned that many more LAs (with apps) will be created. Each of them would focus on distinct borrower pools and build the specialized experiences suited to their customers. This would allow lenders to focus purely on their underwriting and collections logic and cater to diverse collaborations with the LAs.

OCEN 4.0

The OCEN model has been built incrementally in phases, with reinforced learnings from each of the previous pilots. The goal for OCEN 4.0 is to build an ecosystem of participants that creates a Cambrian explosion of cash-flow based loan products across different MSME sectors and different types of borrowers.

Participant Roles

OCEN 4.0 supports specialized roles for the participants. The purpose of introducing new roles is that it promotes specialization and enhances system efficiency. For example, by establishing a local network of participants, the burden on lenders is reduced, resulting in increased credit accessibility in underprivileged areas.

| Role | Description |

|---|---|

| Lender | Lenders are the regulated entity that create and own the credit products. They work with other participants as part of a Product Network to serve the Borrower. The Loan-agent understands the borrowers’ credit requirements and works with the lenders to create the product. |

| Loan-Agent (LA) | Agent of the borrower who will help the Borrower to pick up the best loan offer. The Borrowers agent will charge the Borrower a fee for helping them select the best loan. Loan agent is a more inclusive term that encompasses both Borrower Agent (BA) and Lender Service Provider (LSP), spanning across the existing DLG model referred to as LSP and the emerging model in which BA operates as the borrower agent. |

| Derived Data Partner (DDP) | A derived data provider is a collaborating partner within the network that furnishes supplementary data to the Lender, aiding in enhancing their underwriting engine with additional information. |

| Collections Partner (CP) | A Collections Partner is a network-affiliated collaborator designated by the Loan Agent (LA) to aid in the collection process. The lender retains the option to either opt for the Collections Partner or continue using their existing collection procedures. |

| Disbursement Partner (DP) | A Disbursement Partner (DP) is responsible for supporting Purpose Controlled products. This partner will establish integration with suppliers, retrieve their catalog, and facilitate seamless direct payments to suppliers within the OCEN journey. |

| KYC Partner | A KYC partner is a collaborator selected by the Loan Agent (LA). This partner can be engaged for Assisted KYC or any technology-related specialization available on the network. The lender retains the choice to employ the KYC partner within the network or continue with their existing procedures. |

In addition to the participant roles above, OCEN framework also relies on Account Aggregator and Credit Guarantees (CGTMSE) as part of the loan journey.

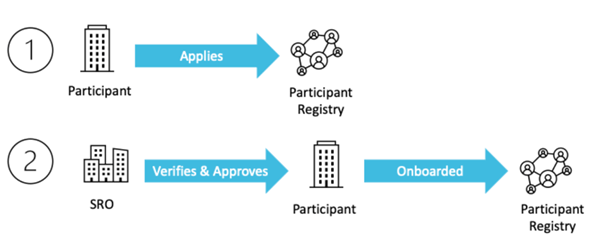

Participant Onboarding

All participants are onboarded to OCEN 4.0 via the participant registry. A standard onboarding process is followed for all participants, and their verification is guaranteed by SROs to ensure that new members receive an equivalent level of trust within the network.

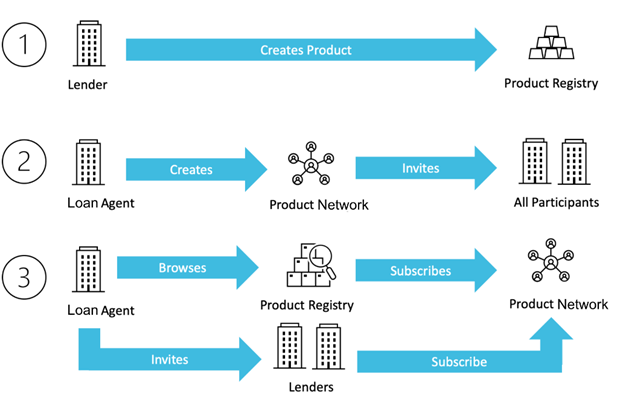

Product and Product Network onboarding

Lender will create & manage the Product and the Loan Agent will create & manage the Product Network to serve that product. All participants in OCEN 4.0 can browse the Products and Product Networks on the Product Registry and subscribe to serve a Product via the Product Networks.

Product Networks

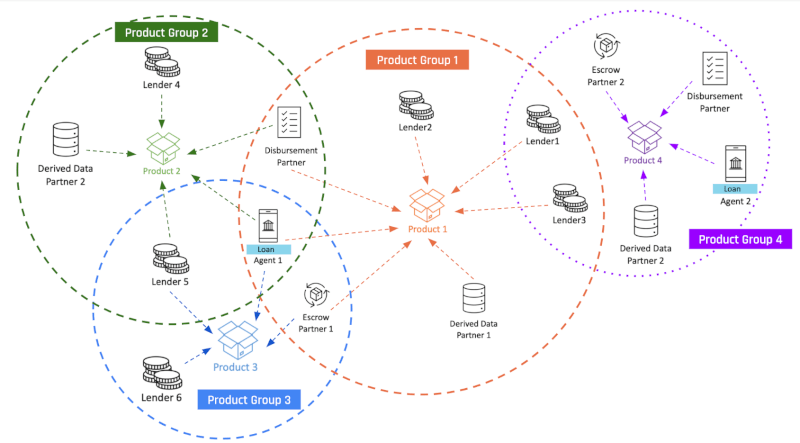

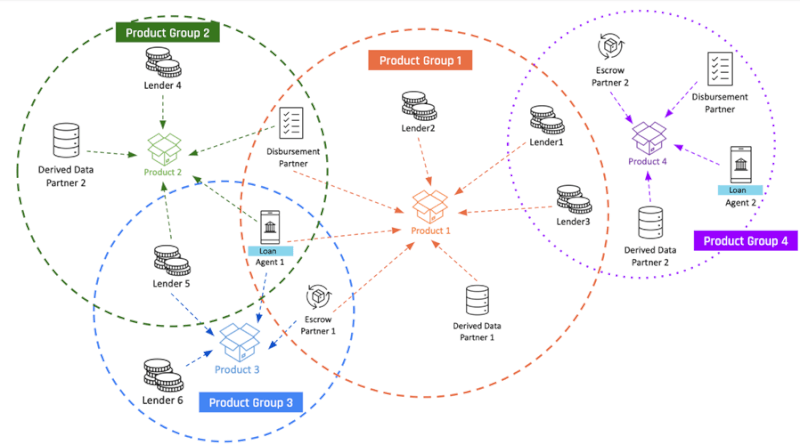

OCEN 4.0 enables a network of product networks that participants can discover, collaborate and serve products to borrowers. See sample example below:

- Network begins with Product Network 1

- Created by Loan Agent 1 who onboards as network participants – 3 lenders, disbursement partner, collections partner and a derived data partner

- Loan agent 1 can serve their borrowers other products as well.

- Network expands with Product Network 2

- Created by Loan Agent 1 who onboards as network participants – 2 new lenders, the same disbursement partner, and a new derived data partner

- Loan agent 1 can continue to serve their borrowers other products as well.

- Network expands with Product Network 3

- Created by Loan Agent 1 who onboards existing participants and a new lender (Lender 6) to serve the product

- Participants can discover products and join the product network

- Network expands with Product Network 4

- Created by a new LA, Loan Agent 2, who onboards existing and new participants to serve the product to their borrowers

OCEN Examples:

GeM SAHAY

GeM is a short form of one stop, ‘Government e-Marketplace’ where common user goods and services can be procured by various Ministries and agencies of the Government. Government e Marketplace (GeM) offers both products and services as part of its offerings to its registered buyers. GeM facilitates the procurement of a spectrum of Product and Service categories in a way to facilitate Buyer in ease of selection and procurement. GeM SAHAY is an online platform built on the OCEN protocol that provides loans against Purchase Orders to the sellers.

GeM SAHAY is the pilot project on OCEN to validate the idea of cash-flow based lending for MSMEs. In this pilot, GeM (Government e-Marketplace) is the Loan Agent. The Lenders onboarded onto the pilot offer loans to MSMEs on the GeM portal against government purchase orders. The pilot validates that short-tenure, small-ticket size loans enabled via the OCEN network works for all participating parties.

GeM as a Loan Agent allows the Goods and Service Providers on GeM to apply for Loans against Purchase orders received through various Government buyers on the GeM portal.

GeM as a Loan agent helps onboard borrowers for lenders reducing the acquisition cost for the lenders

GeM being a loan agent also acts as a Derived Data Provider as it carries rich data of the participating MSME borrowers in terms of past number of orders, value of orders executed, quality incidences, completion timelines, etc and these data points help the participating Lenders to underwrite the MSME loan application.

GeM facilitates digital loan process for MSMEs on its GeM SAHAY portal by ensuring integration with multiple lending institutions and helps the Borrower MSMEs to receive multiple offers for its loan applications. Allowing the MSME to choose the best suitable loan offer creates a market shift from Lender’s market to Borrower’s market.

GeM also acts as a Collection partner for the Lending institutions as it helps the lender with repayment of the loan for the purchase order though the Escrow account where the payment for the orders executed is credited by the purchasing entities.

GST SAHAY

A second pilot that expanded on the above is the GST SAHAY pilot project. This pilot uses GST data to enable working capital loans where SIDBI is acting as the Loan Agent. An additional parameter for validation on this pilot was the inclusion of the Account Aggregator data for loan underwriting.

In GST SAHAY, borrowers can seek loans against unpaid B2B Invoices for supply of Goods and Services to other businesses. Any business registered with GSTN and filing the statutory returns on GSTN can seek financing against Invoices where goods or services are supplied on credit period.

Borrower can register on GST SAHAY application and upload Invoices against which it seeks to avail financing.

The GST SAHAY application, after seeking the consent of borrower will pull details available from the GST network for its past invoice transactions filed with GSTN, periodic return filings and share the same with Lenders for evaluation and underwriting and credit decisioning.

Similarly, GST SAHAY application after seeking the consent of the borrower will pull details of the Bank statements available from Account Aggregator framework for its past banking data and share the same with Lenders for evaluation and underwriting and credit decisioning.

Lenders will parallelly also check the Credit Bureau of the borrower to assess credit worthiness and past performance on existing credit facilities from other lenders, if available.

Lending institutions will digitally consume all these data points, along with details available on the Invoice to be financed and by using its proprietary rule engine for underwriting and scoring model, will provide an offer to the borrower for the respective Invoice to be financed.

Borrowers may receive multiple offers (higher loan amount, lesser interest rate, longer tenure) from different Lenders based on their evaluation criteria and will have a choice to select the best suitable offer for seeking the disbursement in a digital way by e-signing the loan agreements, e-Nach / Standing instructions, wherein the amount will be credited to the borrower’s account within few minutes.

There are other OCEN innovative product networks which are at various stages of development and are expected to go live to provide seamless credit to the credit starved MSMEs using OCEN API specifications for communication between the parties (Borrowers, Lenders, Loan Agents and other participants)

For more information, please visit: http://ocen.dev

❓Questions? Submit your questions here.

📩Contact? Reach the OCEN 4.0 team at [email protected]

Please note: The blog post is authored by our volunteer, Rahul Bhaik