Harbouring an idea in your head is one thing. Taking the leap of faith to execute, nurture and grow the idea is an entirely different ball game.

It calls for a tribe of people that we call Entrepreneurs.

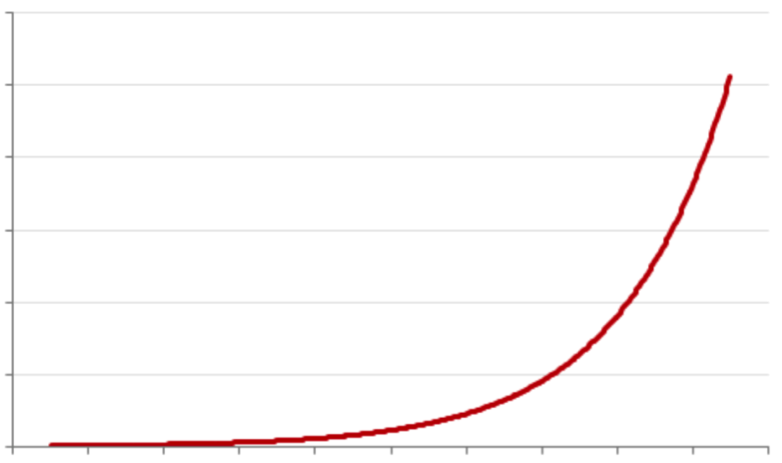

Fortunately, this breed is on the rise. They make this game look deceptively simple.

Apart from the fact that you have to face a fair amount of social ire and family grumpiness, launching your own business and getting it off the ground comes with its unique set of challenges, the foremost of which is the problem of “scarce resources”. Your money tree will take months, sometimes several years to sprout.

One of the most valuable lessons we can learn is that there are several tools and apps for various functions that have grown all over the internet to help us overcome this “limited resource syndrome” that startups acutely suffer from.

We faced this challenge of limited resources in our early days too. In our experience, here are some of the biggest challenges faced by an early-stage startup that the appropriate tools can help you combat.

Bringing order to your sales pipeline

Sales requires a combination of people skills and product know-how. It also demands that we make sense of what the customer wants, and quickly dive into seeing what they need.

While getting those first few paying customers is about networking and selling within your circle, there comes a time when you have to start casting your net wider.

It is important at this point to have a process and tackle sales in a methodical manner.

While you can make do with Excel sheets for the first few months, they will add to the chaos as your customer base grows. Investing in a CRM tool becomes mandatory at that point.

This simple tool will allow your sales team to focus on selling and not waste time on decoding the sales pipeline and customer information that would be scattered all over the place without a CRM.

Working together as a team

Needless to say, one of the biggest assets for a startup is its people. For an early-stage startup, the people are the company’s only assets.

A startup environment requires people to fill multiple shoes and wear multiple hats. Not to mention that people now consider remote-working a norm – thanks to technology.

Team collaboration tools can help a great deal with keeping the team together and assist the project manager in assigning tasks in a more meaningful manner. It’s easier to keep track of projects and the status of tasks, and come up with contingency plans better.

Plus, it helps keep the sense of purpose alive in the team.

Without a tool to keep track of what the entire team is working on, it is easy to lose sight of the priorities of things that need to get done.

Creating a brand following

In the bygone era, marketing used to mean plonking billboards on the highway or buying TV spots for blaring commercials. Today, marketing means mastering the nuances of social media. It means building an email following. It means adding value through useful content and leveraging SEO.

Typical tools like social media scheduling tools to manage multiple social media accounts, email marketing tools, content management tools and analytics tools that integrate with your website are must-haves to keep your visitors and customers engaged.

This is also a way for the team to measure, analyse and learn from their experiments. Building on what works and scrapping the things that don’t is an important step forward in the growth of the company.

Design

Design is not just about aesthetics anymore. It has become an absolute necessity.

According to research, coloured visuals can increase your audience’s engagement with your offering by 80 percent.

Whether you need a website designed, a blog image or simply an image to go with a social media post, there are several tools to make your life easier – even if you have never been anywhere near a design school in your life.

Managing the monies

Amidst all the high-energy events in a typical startup workday, finance can be the one thing that will be happily relegated as the last priority – only for it to get back at us with a vengeance during those closing days. Not to mention that most startups don’t exactly consider hiring a dedicated accountant at this stage.

Here again, somebody has mercifully created tools for the non-accountants to look up and still smile after “crunching numbers.”

If you have the resources to invest in just one tool, let this be it. Trust us, you’ll thank us for it.

Connecting with your customer

“Your most unhappy customers are your greatest source of learning”- Bill Gates

Understandably, most entrepreneurs seek to meet a critical need in society that can be fulfilled by offering a product or service. However, the most well-planned startup can fail in the blink of an eye if they lose sync with the customers who use their products and services.

Customers are a huge part of the startup ecosystem and being accessible to them at every turn can define the success of the product or service.

It becomes imperative that we establish, open and maintain channels for valuable dialogue with our customers while making sure we are listening to them. Again, some amazing tools make this a breeze, while also acknowledging that a startup does not have deep pockets.

To sum up, it’s an excellent time to be an entrepreneur. Countless opportunities exist, and more and more free resources are available to entrepreneurs than ever before.

Tapping into these resources and advice effectively can be the thin line between the success and failure of a startup.

Guest Post by Shivakumar Ganesa(Shivku), Co-Founder and CEO of Exotel, a leading cloud telephony company

‘Preparing for glory’- Like the Spartans, Pensaar too is setting stage for the ultimate revolution. The UnConference, Phase-ll of the Design Thinking Summit is gathering traction and building from a 60+ gathering at Phase-l to now include 300+ participants.

‘Preparing for glory’- Like the Spartans, Pensaar too is setting stage for the ultimate revolution. The UnConference, Phase-ll of the Design Thinking Summit is gathering traction and building from a 60+ gathering at Phase-l to now include 300+ participants.

Startups that fail to comply or neglect HR and payroll laws are often slapped with stringent financial and legal consequences. In fact, some penalties are so stringent that they can throw the entire business off track. With that being said, here are five common yet biggest HR and payroll mistakes that startups commit and why it’s time to embrace a mobile payroll app or cloud-SaaS based payroll software.

Startups that fail to comply or neglect HR and payroll laws are often slapped with stringent financial and legal consequences. In fact, some penalties are so stringent that they can throw the entire business off track. With that being said, here are five common yet biggest HR and payroll mistakes that startups commit and why it’s time to embrace a mobile payroll app or cloud-SaaS based payroll software.