As a startup founder or growth marketer, you obsess over metrics: what is my lead-generation rate, how many customers did I win or lose, how is my monthly revenue growing, or how many customer referrals did I get? Analytics is critical for your business, without which you’re flying blind. However, data overload is real and you might not derive the right actionable insights.

To simplify metric-driven growth for product startups, iSPIRIT, on 18th June 2016, organised a half day roundtable of 11 product startups in Pune. The roundtable was moderated by Paras Chopra, Founder, Wingify and Sanket Nadhani, Growth Marketer, Wingify.

The discussion was structured in a way where attendees spoke about the 3 metrics that are most important to them, an “uncommon” metric that they track, and their expectations from the roundtable. The format was kept fluid with attendees pitching in with thoughts and interesting ideas. At the end of this, all of us saw an exciting video about using Lean Analytics for growing your business.

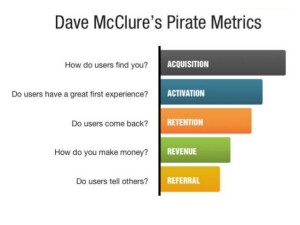

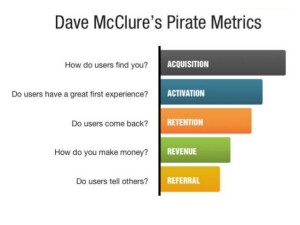

As a growth marketer, I found interesting growth tactics that these startups use and some insightful metrics that they track. I have structured these in Dave McClure’s famous AARRR pirate-metric framework for SaaS businesses.

Acquisition

Where do I get customers from?

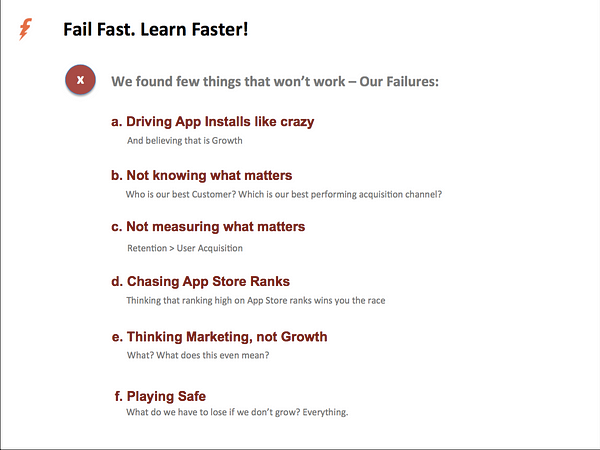

Acquiring new customers is hard. Especially for newly born startups. The best way probably is to just throw mud everywhere and see where it sticks. Once you’ve identified a performing channel, or hopefully multiple channels, you build strategies around them to ramp up acquisition.

Invariably all the startups agree tracking the number of enquiries (opportunities) and their conversion rates across channels is crucial. Paras was of the opinion that keeping an eye on weekly trends on the performance of acquisition channels will help uncover tipping points of when the channel is about to take off or when it’s time to forget about a channel if it has not been performing for a while. To identify optimal acquisition channels, Sandeep Khode, WordsMaya, tells us to ask your customers where they came to know about you. Though it’s a manual process, it helps them to identify users’ exact search terms, which is very useful for keyword optimization. WordsMaya leverages Quora to acquire customers by answering questions or starting a topic.

Jayesh Kariya, VP Finance, TouchMagix, contributed an interesting idea that maintaining a trend of number of prospects lost every week is an eye opener. This lends the idea that your startup should improve its own performance week-on-week.

Landing pages and pricing pages plays an important part in customer acquisition. However, due to information overload, 55% percent of visitors spend fewer than 15 seconds on a new website. Optimizing landing page was a top priority for everyone. Paras told us that a landing page should tell a complete story; it should give all the information that the visitor wants in as few words as possible. Amit Mishra, CEO, InterviewMocha shared an excellent framework, HABITS, to design landing pages. He also says that inserting call to action buttons on your own blog posts gives a click-through rate of around 2%, effectively using your own website as an acquisition channel.

Activation

Oh! I got 1000 signups in a day but nobody used the product.

This sucks, right? To improve activation rates, answer this question: once someone signs up, how quickly can she actually use your product? In other words, how soon does she realise the product’s value proposition? If it’s not soon enough, the user goes away never to return.

The onboarding experience of a user should be smooth and, importantly, short. You should NOT ask a user to fill out a form with more than four fields. Some of the tactics and metrics that were discussed –

- Keep the on-boarding experience short. Examining onboarding experiences of other companies will help you design your own.

- Measure the ratio of number of users who sign-up to number of user who complete onboarding. Make sure that you measure every step if you have a multi-step onboarding process.

Retention

I signed up a 1000 users a month back. Today, only 10 of them are using my product.

Customer Retention is the real growth accelerator. The math is quite simple: 1 – 1 + 1 = 1. If you don’t retain customers, there’s no use acquiring them. Here’s a great infographic with helpful tips to boost customer retention and reduce churn.

Vrushali Babar, Founder, Meatroot, a B2C business, says that it’s crucial for her to retain her customers. She says that sentiment analysis of what her customers are saying online is indispensable. She currently does it manually on Twitter or Facebook but using a tool like Sentiment140 or BuzzLogix could be useful.

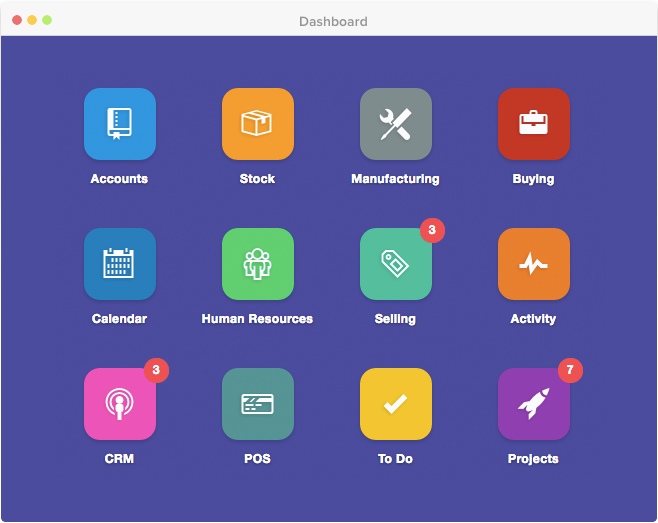

A useful exercise could be developing a dashboard that plots the engagement of users with your product on a daily basis. The philosophy is that a customer who is not engaged will leave. Such a dashboard will give you a snapshot of when engagement of a customer is on the decline so that you can take proactive action before the customer cancels. Another useful metric, for SaaS businesses, is to measure the number of sessions for a user during the trial phase. This will let you know which users are more likely to convert to a paid subscription.

To demonstrate how important is customer retention, Sagar Bedmutha, CEO, Optinno Mobitech takes this issue to an obsessive level. When a user submits a rating of less than 4 on their app on the Play Store, he tracks the user, fixes the bug, and sends a test app to the customer! He says, this personal touch often makes the user change her rating and helps Optinno maintain good ratings, the primary driver of app installs.

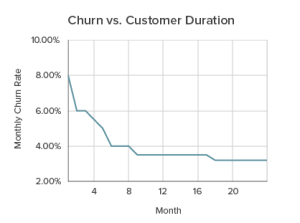

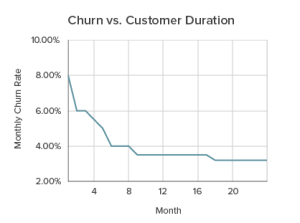

Paras contributed a great insight on how to properly measure churn rates. He says, that measuring the average churn rate doesn’t help uncover the reason for the churn. Instead, you should do a churn cohort analysis, that is, measure the churn rate segmented by customer cohorts. Examples of cohorts could be the number of months a customer used the product before leaving, the specific features churned customers use, etc.

Let’s say you have 100 customers and 5 of them leave in a given month. Your churn rate turns out to be 5%. However, the graph above makes it clear that the churn is much higher for customers who are less than 6 months old after which the churn is much lower. This points to a problem with activation: customers drop off when they are not fully activated.

Revenue

I have over a 1000 customers, but I am not making any money.

A bad problem to have! Businesses should make money from the customers they serve. This, seemingly obvious, fact sometimes slips away when you are working on many things. Measuring how much revenue you’re generating month-on-month (monthly recurring revenue) is indispensable.

Not only should you track revenue growth, you should work towards increasing it in ways other than signing up new customers. A great way to do that for SaaS businesses is upselling. Upselling lets you get more revenue from one customer and help you define and build the whole product. Kaushal Sanghavi, co-founder, BreathingRoom takes this a step further by saying that maintaining a predictable revenue stream is important. He is trying various techniques and says that incentivizing customers to pre-purchase, or buying in bulk for future use, is showing a lot of promise.

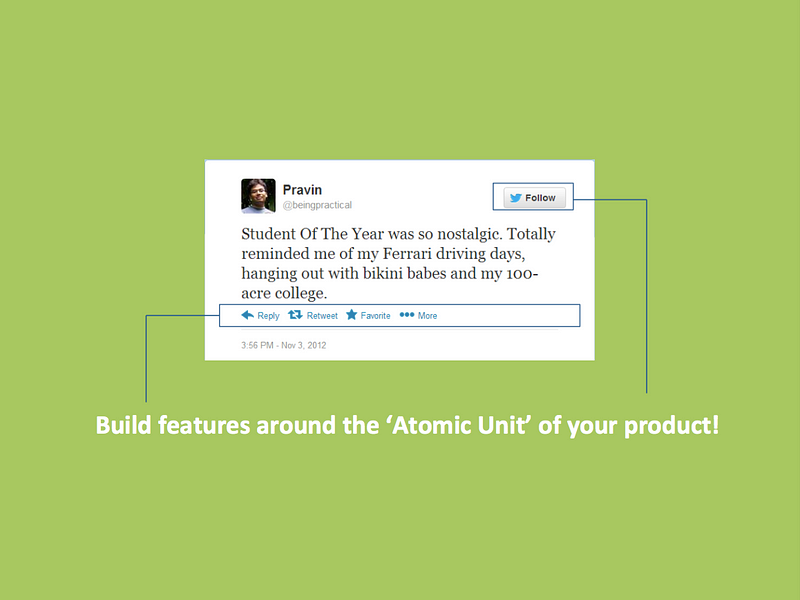

Amit seems to have perfected the art of upselling. He says not to wait to build out a feature before upselling to your customers. Sell as soon as you have an idea. Doing so will give you insights on which are the features customers really want and help you prioritize your product roadmap.

Referral

How I wish my customers referred more customers to me!

A working referral system is what differentiates SaaS companies. An amazing referral system, like that of Dropbox’s Refer-a-Friend, is probably the easiest thing that can bring exponential growth.

Building a working, and non-creepy, referral program for your startup is hard. From my experience, most experiments fail. But you can look at some successful referral implementations and learn from them.

Amit tells that monetarily incentivizing salespeople to follow up with their customers and ask them to write reviews on various web directories has worked well for him to acquire more customers. InterviewMocha, an online assessment software, stores email addresses of people that their system collects, follows them on LinkedIn, and when someone changes a job, reaches out to them to install InterviewMocha in their new companies. Though manual and time-taking, this method, I believe, justifies the ROI.

Final Words

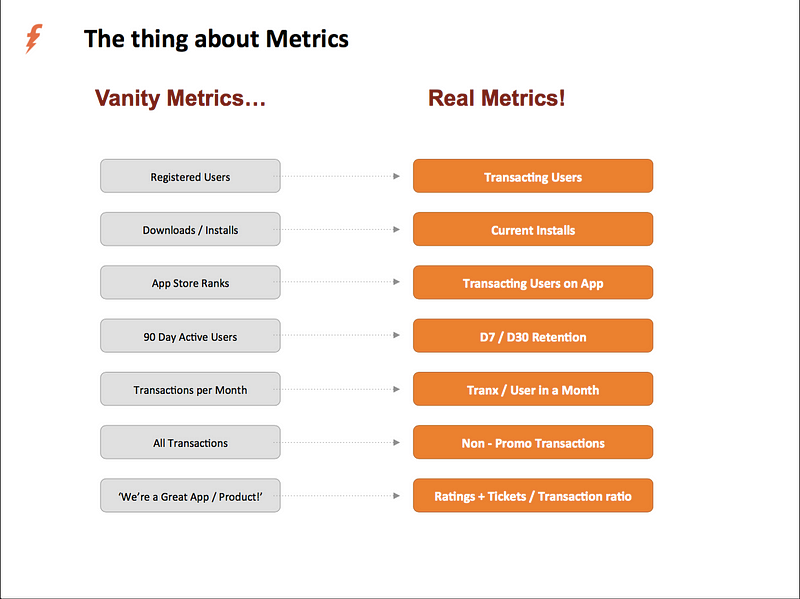

There are a lot of metrics that you can track and you probably are. It’s easy to get lost. The video from Google Ventures that we saw makes a great statement: for a company of a type at any stage of the company, there is one metric that is the most important, which you can’t afford to not track.

As a founder, keep an eye on that one metric and just focus on growing that metric. Here’s a PDF of what that metric is.

At the end of the event, I caught hold of Sanket to pick his brain. One of the main questions I had was what does a founder do when he is just starting out and does not have too much data to derive insights from. Customer Interviews. When you’re small, you can afford to pay attention to each customer. In turn, those customers, often happy with the personal touch, will tell you what they want exactly and give you insights that no market research can.

Customer Interviews are tricky: if you don’t conduct them well, you won’t get the insights that you want. Or more dangerously, you will listen to what you want to listen and fail at validating your assumptions. Spend effort in creating good user interviews and refine over time.

I hope that this post gives you an overview of why metrics are important to grow your business, how to define appropriate business metrics, and learn how startups are already doing so.

About the author – Siddharth Saha – a Product Marketer with an interest in full stack marketing. Questions? Criticisms? Insights? Shoot him an email on [email protected]

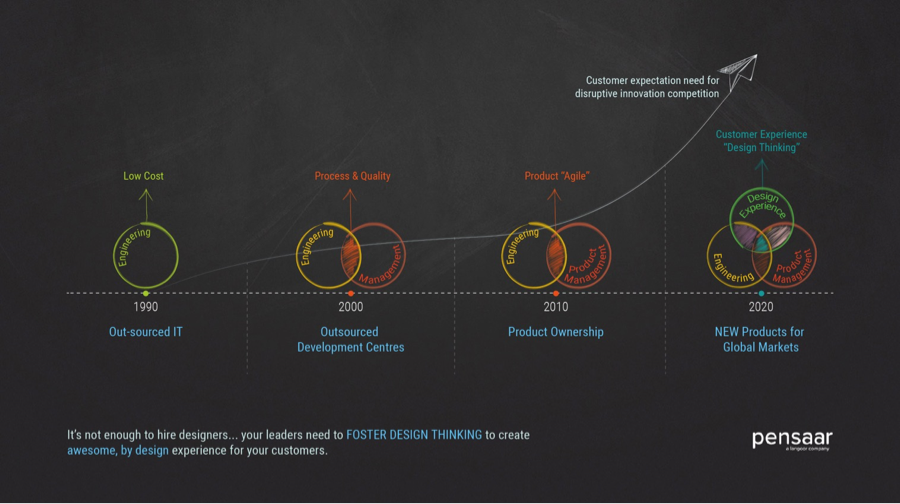

Not surprising that companies (of every shape, size and origin) are struggling with innovation. Good work is happening, the right interventions are being made but these interventions are happening in silos. One is left with the feeling that “some secret sauce is missing”. Is there a secret sauce? And is it missing?

Not surprising that companies (of every shape, size and origin) are struggling with innovation. Good work is happening, the right interventions are being made but these interventions are happening in silos. One is left with the feeling that “some secret sauce is missing”. Is there a secret sauce? And is it missing?

Check out the message in the screen above. The error message not only has a “personality” but also nudges the user to complete the required task before performing an action.

Check out the message in the screen above. The error message not only has a “personality” but also nudges the user to complete the required task before performing an action.