Introduction

OCEN plays a pivotal role in revolutionising MSME lending in India. This innovative open network is specifically designed to serve those new to credit, employing an omni-channel approach that democratises and simplifies access to lending.

Currently, the market lacks a scalable and profitable model for short-term, low-value MSME loans – a significant gap that OCEN has adeptly filled with its GeM-SAHAY pilots.

Amidst the confusion and excitement surrounding OCEN versus ONDC, and the broader impact of open networks in the lending sphere, this blog aims to provide clarity and insight. Let’s dive in and explore these transformative developments.

🔀 OCEN or ONDC: Which is better for short tenure MSME lending?

There’s much debate about which lending framework potential partners should explore. Rahul Mathur (Associate Director, InsuranceDekho) captures this perfectly in his tweet, presented as a checklist below:

(1) 💰Type of loan: Type 1 personal loan v/s Type 4 MSME loan

(2) 🔎GTM: Online v/s Omni-channel (assisted)

(3) 🙇Persona: Eligible for credit v/s New to credit

(4) 🌟Objective: Bring credit to point of commerce v/s Democratize credit access

To summarize, there are some good reasons why ONDC has launched loans independently of the OCEN network.

Over time, OCEN will expand to include further lending use-cases & products. And, at that point, ONDC <> OCEN interoperability would make sense.”

You can find the original post here

Clearly, OCEN is the undisputed option for short tenure, low ticket size lending for new to credit MSMEs. Over time the lending use cases will be expanded to service the traditional form of loans.

OCEN and ONDC, while both operating in the lending space, are tailored for very different use cases and audiences. While they may overlap in some cases, the larger ecosystem benefits from introduction of newer networks. In the end, it’s all about solving the most challenging problems 🙂

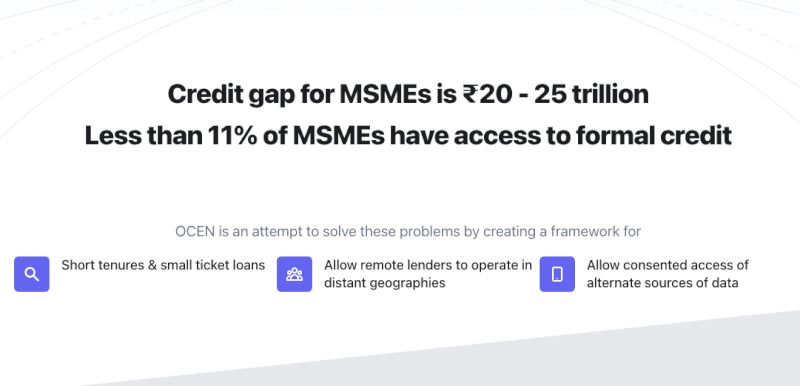

Let’s further understand how OCEN addresses the MSME lending problem in India.

📈 OCEN makes small ticket size lending a reality

OCEN’s primary goal is to make short-term lending profitable. Something which we’ve achieved in our pilots with the Government e-Marketplace, through the GeM-SAHAY app.

One of our volunteers explains the economics in this blog post: Evaluating the short term lending opportunity, where he shows how lenders can earn 2.2x higher revenue with the same capital through the adoption of the OCEN framework.

The significant 2.2x increase in revenue is attributed to the introduction of a crucial role known as the borrower’s agent. These agents not only reduce the cost of servicing a loan but also heighten accountability within the system.

Borrower’s Agents (BAs) assume a variety of roles traditionally outsourced by lenders, BAs function as data providers, collections agents, escrow account managers, and product providers.

By integrating these services and cohesively binding the network, BAs enable lenders to efficiently service low-cost loans even in remote areas. In performing these four key roles, the borrower’s agent emerges as the cornerstone of the open network, vital for its effective operation.

The role of borrower’s agent has been discussed in depth in one of our open house sessions:

OCEN is changing the game by making even the tiniest loans worthwhile for both the lender and the borrower.

🌐 Efficacy of Open networks and streamlining the lending process

Some people we’ve spoken to, worry that open networks will lead to the commodification of lending, which, in turn, is bad for the overall market. However, this couldn’t be farther from the truth 🙂.

OCEN streamlines the lending process by introducing roles such as the borrower’s agent, KYC agents, and collection partners. These roles combine to create a bundle that lenders can easily integrate into their processes to start lending.

Newer and smaller lenders will benefit from the transparency and scale offered by open networks.

Closed network auctions, which are common today, see lenders bidding down for loans. However, their lack of transparency and scale often results in low profitability.

Open networks, on the other hand, provide scale and transparency that leads to low cost of servicing, more borrowers to choose from, and reliability in the system through a borrower’s agent.

Larger lenders benefit from the low cost of servicing a loan that comes with open networks

Larger lenders will benefit from open networks as it provides the technical chops of a borrower’s agent. BAs can help with KYC, collections and other parts of servicing a loan while absorbing some of the costs.

We’ve seen such effects before, with the introduction of Aadhaar and UPI, where KYC and collections became far cheaper enabling large lenders to facilitate smaller ticket size loans.

In conclusion

Through OCEN, the potential to unlock a ~$300 billion credit market in India becomes a tangible reality. This is demonstrated by the increased revenue potential and the introduction of the borrower’s agent role, enhancing loan servicing efficiency and accountability.

Moreover, OCEN’s streamlined lending process benefits the entire market, by offering scalability and cost-effectiveness to both emerging and established lenders.

Thus, embracing OCEN is not just a choice but a strategic direction for expanding market possibilities and empowering both lenders and borrowers in the dynamic credit landscape of India.