A wise and successful entrepreneur once said, “Traction trumps everything”.

Indeed, traction is the only thing that brings you customers, VCs, and energy to keep going.

iSPIRT in partnership with PuneConnect & SEAP organized a playbook roundtable on “Getting traction for your product startup”. It was focused on peer to peer learning and taking away real feedback, rather than just typical “general gyaan”. The playbook roundtable was moderated by two very successful SaaS product entrepreneurs Niraj Rout of Hiver (earlier known as GrexIt), and Rushabh Mehta of ERPNext. Both are building highly successful SaaS products bringing very different approaches/strategies yet finding great synergy in their thought processes. Hiver is a simple-to-use product for business workflows, fast growing, young, funded and profitable startup whereas ERPNext is a highly complex, very stable, bootstrapped, profitable, world’s second opensource Saas ERP product.

The RT discussion was attended by founders building SaaS products in Innovation, eCommerce, business communication, personal customer loyalty, education, personal finance, recruitment, fashion and technology domain.

SaaS Valley of Death: Rushabh got our attention right away by asking “Do you know SaaS Valley of Death?” Its like your product is complex to use and cheap at price. Its very very difficult to sale. You can be either very simple to use and cheap or you can be highly complicated and pricey. You can’t be cheap and complicated. But ERPNext falls in that category. Rushabh briefly shared his long haul journey of 8 years of building a product out of his own need and making it open source for people to use/modify it. ERPNext gives it at fairly low price to host it and charges additional for product consultancy.

Open-Source strategy: Rushabh realised that if such a complex product has to have innovation, then hiring talent is quite difficult. Instead making it open-source brings immediate advantages such as your users brings innovation, it is easy to hire from the developers community which already knows your product code, less efforts needed to support the product as your community is your biggest support structure. Recently, this trend has started by major tech companies like facebook, google and others by making their api’s open-source for community to play around and bring true innovation. Also interesting to say here that open source is more than a marketing strategy, you have to believe in it to work. Also companies are open sourcing not just APIs but also entire projects (Apple just joined with Swift)

User Onboarding: It is very easy to get signups, but what happens after signup is the crucial one. The real game begins from sign up onwards. Rushabh at ERPNext created a great user onboarding workflow for various categories of users. At signup, ERPNext asks its user several questions to understand user and his/her needs. Accordingly, it customises the rest of the onboarding flow. This “personalized” flow helps user to connect and understand ERPNext quite easily. There are several videos created for user to educate about product features and uncover true benefits. “Founding/Core team has to take product to a initial revenue level, until then one should not make a mistake of hiring a sales person”, insisted Rushabh. This helps you build and quickly tweak/change onboarding flow as your know your users better. This also helps in positioning and marketing the product better.

Product Market fit: Niraj of Hiver (GrexIt) shared his journey of conceptualising the product as knowledge management place (for enterprises) to pivoting to tap a SME segment where quick workflow matters. Its all about finding a product-market fit. On a lean methodology which suggests to work with your customers and tune the product, Niraj shared a good observation. If you talk to your customers, they will always suggest small incremental improvements/suggestions, customers can never give you extraordinary (or 10X) innovation. Its your vision that defines what your product could actually do. However it’s essential to understand how users are using the product and what key activities they are doing repeatedly.

Buyer’s mindset: For a product, you have to understand whether it helps user generate money or save money. Does your product falls into cost center or revenue center, accordingly you have to create your marketing campaigns and positioning.

Simple Growth hacks: Startups don’t have big pockets to spend on marketing/sales. Simple techniques like Your domain specific keywords, Search Engine Optimization, Influential bloggers write about your product, your customers talking and referring your product are a few simple growth hacks every startup can try. Always get real customer’s/brand’s testimonials and showcase them on key pages.

Critical choices: In the initial days when you don’t have traction, its an important call whether you want to give it to a few people and learn and tweak the product or you just throw it in the space for thousands to use and let them figure out. Both have their own pros-cons.

Post Lunch session, Niraj and Rushabh encouraged every startup to showcase their product’s landing page and quick onboarding workflow. Duo and other founders provided critical feedback to individual founders with immediate actionable takeaway. It was a great peer-to-peer learning exercise. Below is a summary of what came out of the discussion that generically applies to most SaaS product startups.

Landing page: Product’s landing page is the most critical real estate. Be innovative and build it wisely with new/current trends. A few examples of well designed landing pages were discussed. Products from 37Signals (Basecamp and KnowYourCompany) were highlighted for their innovative approaches. Like Steve Jobs once said, “Good artists copy, great artists steal”, you need not to always reinvent the wheel, just see the best products in your category and steal (find inspiration)!

A few tips for a well designed landing page –

1) The main image and punchline should be appropriate for user to understand your product quickly. Thats where user decides whether I should scroll down (to know more).

2) Always talk about benefits user will get, nobody cares about features.

3) More than 3-4 scroll is overdone. Have only essential information upfront so that user is not overwhelmed with information overdose.

4) Testimonials from real user/brands works great, people feel more comfortable.

5) Less verbose, more visual is always better.

After Signup (User onboarding): Engaging with user for first few days and making personalized communication helps build rapport as well as improve stickiness.

1) Build a user friendly Quick tour with an option to quit and restart

2) Let user experience your product as quickly as possible

3) Videos or user guides “How to” are essential and helpful

4) Website and user behavior analytics tools like Google analytics, KissMetrics, Mixpanel provide good data know your users better and make appropriate changes in your product

5) Intercom like products helps you build user behavioral based engagement

6) Provide triggers/incentives to appeal user to perform certain actions. Nir Eyal’s HOOK framework (Trigger, Action, Reward, Investment) was briefly mentioned to emphasise the point.

7) Your product is a leaky bucket, user may fall off anytime. Identify such holes and fill them up with creative solutions

7) You don’t have to be too generous with free plan. Start asking for money (plan upgrade) for valuable/exclusive features

8) Track analytics daily to know traffic to trial to paid customers journey

9) Always do A/B testing of every change/tweak you make to understand how its working.

10) Understand, there is always a churn. Account for that

11) Always promote long term (annual payment) plans, it gives you better visibility on your revenue.

As traction book says, “Almost every failed startup has a product, what failed products don’t have are enough customers (traction)” and “Traction is growth. The pursuit of traction is what defines the startup”.

This playbook RT was first of its kind where only real stuff was discussed and critical feedback was provided to every startup on their product traction leaky bucket. All startup founders walked out with several actionable takeaways.

There are great SaaS product startups coming from India. The successful entrepreneurs like Niraj and Rushabh have vigor to share their learnings and help budding entrepreneurs to avoid mistakes and leapfrog their journey. This is a movement to build a product nation, one roundtable at a time.

Guest post by Abhijit Mhetre founder at Canvazify – a structured innovation platform for teams to collect, brainstorm, and act on ideas. Abhijit is passionate about startups and collaborative innovation. Follow Abhijit @abmhetre

![]()

![]() I will join your bandwagon soon

I will join your bandwagon soon ![]()

![]()

In this Round table, Aneesh was leading and moderating the discussion. He leveraged the experience of other founders which made the most out of few hrs of interaction. The participants are founders of mid-stage startups, who have good-size customers and have decent ARR (Annual Recurring Revenue), growing and scaling.

In this Round table, Aneesh was leading and moderating the discussion. He leveraged the experience of other founders which made the most out of few hrs of interaction. The participants are founders of mid-stage startups, who have good-size customers and have decent ARR (Annual Recurring Revenue), growing and scaling. How to acquire customers in new international market?

How to acquire customers in new international market? How is to do pricing for your product?

How is to do pricing for your product? How to provide incentives for your IS(Inside sales) team?

How to provide incentives for your IS(Inside sales) team? He is the author of the book Branding INDIA, a key driver behind many successful branding INDIA campaigns like Make-In India, Incredible India, and Athethi Devo Bhava (Guest is God) campaigns. He is a decision maker par excellence and above all the Secretary of DIPP (Department of Industrial Policy & Promotion). Mr. Amitabh Kant. who is now also in charge of Startup India, Standup India campaign, met up with iSPIRT, in Bangalore to understand the plethora of Technological Break-throughs and Policy Transformations that iSPIRT is facilitating for the benefit of the Startup Community. He provided some very useful advise by participating in interactive session for close to 2.5 hours.

He is the author of the book Branding INDIA, a key driver behind many successful branding INDIA campaigns like Make-In India, Incredible India, and Athethi Devo Bhava (Guest is God) campaigns. He is a decision maker par excellence and above all the Secretary of DIPP (Department of Industrial Policy & Promotion). Mr. Amitabh Kant. who is now also in charge of Startup India, Standup India campaign, met up with iSPIRT, in Bangalore to understand the plethora of Technological Break-throughs and Policy Transformations that iSPIRT is facilitating for the benefit of the Startup Community. He provided some very useful advise by participating in interactive session for close to 2.5 hours. iSPIRT Show-case of various Ongoing Initiatives

iSPIRT Show-case of various Ongoing Initiatives Insights and Advise from Mr. Amitabh Kant

Insights and Advise from Mr. Amitabh Kant The keynote address was followed by sessions and demos by four select software product companies that have introduced innovative products and / or business models leveraging these influences and making the ‘new’ Fintech happen.

The keynote address was followed by sessions and demos by four select software product companies that have introduced innovative products and / or business models leveraging these influences and making the ‘new’ Fintech happen. The panel where status quo meets disruption was highly animated discussion led by Prof Phatak and with two participants from the startup/VC community – Haresh Chawla from IVFA & Sanjay Swamy from Prime Ventures – Dr Ajay Shah and Anand Bajaj, Head of Innovation at YesBank. Dr Phatak opened by stating the time is ripe for disruption and to move to a cashless and cardless world of mobile only payments. Mr Chawla was of the view that innovations will come once the cost of moving money between accounts is near zero – and the next wave of innovations will be around applications of low cost payments. Dr Shah was of the view that the regulator still needs to encourage disruptions and remains a risk to the innovation ecosystem if they stop innovations. Mr Bajaj, fresh from the signing of the MOU between YesBank and iSpirt to setup a framework for a banking app store reiterated the bank’s desire to partner with the startups as they innovate. Mr Swamy called for the need to remove some of the obstacles in on-boarding customers for electronic payment acceptance, and asked for a framework for piloting new concepts. Overall the panel raised several real issues that were actively debated – questions from the audience also echoed the fact that most of the points raised were relevant and real issues. Over the coming months we hope the banking industry will address these issues head-on and SRT the stage for India to maximize the opportunity of the new disruptive technologies from Aadhaar to biometric authentication to IMPS and the Unified Payment Interface.

The panel where status quo meets disruption was highly animated discussion led by Prof Phatak and with two participants from the startup/VC community – Haresh Chawla from IVFA & Sanjay Swamy from Prime Ventures – Dr Ajay Shah and Anand Bajaj, Head of Innovation at YesBank. Dr Phatak opened by stating the time is ripe for disruption and to move to a cashless and cardless world of mobile only payments. Mr Chawla was of the view that innovations will come once the cost of moving money between accounts is near zero – and the next wave of innovations will be around applications of low cost payments. Dr Shah was of the view that the regulator still needs to encourage disruptions and remains a risk to the innovation ecosystem if they stop innovations. Mr Bajaj, fresh from the signing of the MOU between YesBank and iSpirt to setup a framework for a banking app store reiterated the bank’s desire to partner with the startups as they innovate. Mr Swamy called for the need to remove some of the obstacles in on-boarding customers for electronic payment acceptance, and asked for a framework for piloting new concepts. Overall the panel raised several real issues that were actively debated – questions from the audience also echoed the fact that most of the points raised were relevant and real issues. Over the coming months we hope the banking industry will address these issues head-on and SRT the stage for India to maximize the opportunity of the new disruptive technologies from Aadhaar to biometric authentication to IMPS and the Unified Payment Interface. This is was the first Fintech event for iSPIRT in Mumbai and it received record registrations. IGIDR FRG event organizers expressed desire to conduct a dedicated event based on the positive feedback received.

This is was the first Fintech event for iSPIRT in Mumbai and it received record registrations. IGIDR FRG event organizers expressed desire to conduct a dedicated event based on the positive feedback received. There were three broad themes that were covered — finance, healthcare and education — each of which forms an important part of the Gates Foundation’s work in philanthropy. Product demos included the

There were three broad themes that were covered — finance, healthcare and education — each of which forms an important part of the Gates Foundation’s work in philanthropy. Product demos included the  Bill Gates observed that India is producing cutting-edge work and there are few countries which can boast of a digital infrastructure as sophisticated as we are producing here. With such positive encouragement from one of the most accomplished individuals in the world, the vision of transforming India at large through application of technology has received a new impetus.

Bill Gates observed that India is producing cutting-edge work and there are few countries which can boast of a digital infrastructure as sophisticated as we are producing here. With such positive encouragement from one of the most accomplished individuals in the world, the vision of transforming India at large through application of technology has received a new impetus. Guest Post by

Guest Post by  Centuries ago Columbus took an adventurous sea journey to discover India in search of gold and in the process stumbled upon America. It is ironical that after ages we Indian product entrepreneurs are re-embarking upon the journey to rediscover America in search of gold, just that we no longer trust the sea and prefer to go via the cloud.

Centuries ago Columbus took an adventurous sea journey to discover India in search of gold and in the process stumbled upon America. It is ironical that after ages we Indian product entrepreneurs are re-embarking upon the journey to rediscover America in search of gold, just that we no longer trust the sea and prefer to go via the cloud. There is a school of thought which believes inbound marketing using content and blogs gives you good quality low cost leads over time. I personally belong to that group having built SalesPanda, an inbound marketing product. But there is another set of people who feel its better to go target the exact customers you want to bring in via outbound. I must say this round table was dominated more by the latter than the former. Like Sachin from Insidesalesbox.com shared the perfect analogy of fishing with a spear and not the net, its yours to choose. In the same room we had two successful startups using both the methodologies successfully. On one side we had Samir our speaker from shop socially who has 70% of leads from outbound email and telecalling and other side we had Sidharth from Wingify(VWO) who have 70% leads from inbound content. Ideally you need to master both and leverage one with the other.

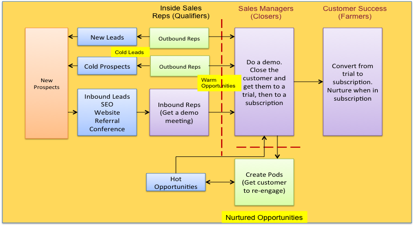

There is a school of thought which believes inbound marketing using content and blogs gives you good quality low cost leads over time. I personally belong to that group having built SalesPanda, an inbound marketing product. But there is another set of people who feel its better to go target the exact customers you want to bring in via outbound. I must say this round table was dominated more by the latter than the former. Like Sachin from Insidesalesbox.com shared the perfect analogy of fishing with a spear and not the net, its yours to choose. In the same room we had two successful startups using both the methodologies successfully. On one side we had Samir our speaker from shop socially who has 70% of leads from outbound email and telecalling and other side we had Sidharth from Wingify(VWO) who have 70% leads from inbound content. Ideally you need to master both and leverage one with the other. Once the database is ready, import it to a marketing automation tool, in case of sell socially they use Pardot. Create a drip marketing campaign across different offering. Segregate the prospects as R,C,O – People who respond,click or open your mailers. The inside sales team calls out to people who atleast clicked on the email so its never a cold call as atleast the customer has heard about you before. The chart below details the emailing process. The prospects move to a CRM solution where the lead is progressed. Shop socially use Salesforce and Sugarcm but any other good CRM would do. Ajay from Salezshark also shared how their CRM software provided an integrated mobile ready solution. It have built in contact database seamlessly integrated into the solution. Do check out !

Once the database is ready, import it to a marketing automation tool, in case of sell socially they use Pardot. Create a drip marketing campaign across different offering. Segregate the prospects as R,C,O – People who respond,click or open your mailers. The inside sales team calls out to people who atleast clicked on the email so its never a cold call as atleast the customer has heard about you before. The chart below details the emailing process. The prospects move to a CRM solution where the lead is progressed. Shop socially use Salesforce and Sugarcm but any other good CRM would do. Ajay from Salezshark also shared how their CRM software provided an integrated mobile ready solution. It have built in contact database seamlessly integrated into the solution. Do check out ! So here we go, the last 25. #Pngrowth 2016 is well and truly on!

So here we go, the last 25. #Pngrowth 2016 is well and truly on!