You’ve shaped up your business idea to flag off. You have a pool of talent believing in that idea and lined up with working prototype with feedback. Now, it’s time for funding to take your idea to concept to design to product to a successful business.

Depending on the idea, startup projects can be particularly expensive and often incur new, unforeseen costs. That is particularly true of technological ideas, which are currently in vogue but require exploratory costs (to pay experts to determine if the idea is feasible) and initial product development costs. Even if a team proves the idea is feasible, they often need to build a working model or prototype to prove that to investors, which can sometimes add thousands of dollars to startup expenses.

The vital idea behind bootstrapping in commercial means is to borrow as minimal finance as possible. In two words, you only rely on either on your own budget and savings, on some crowdfunded amount or simply on loans from friends and family. This scenario urges you to borrow insignificant amounts of money and thus keep interest costs minimal. But as the market dynamics populates further, the wider entrepreneurial community starts delivering differing views.

Guy Kawasaki has proclaimed that “you should always be a boot-strapper… too much money is worse than too little” but goes onto to suggest “if you do get offered venture capital, take it, but don’t spend it”.

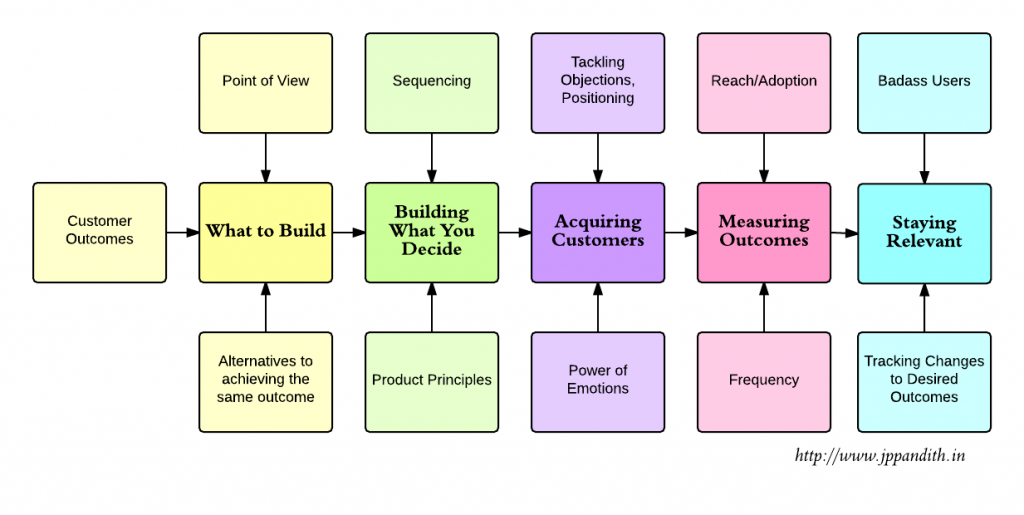

Most people focus all their time and attention on building their idea, and forget that even the coolest product or service is worthless if people don’t use it. Creating a successful product or service requires two things:

- A solid implementation of the idea.

- People that use it.

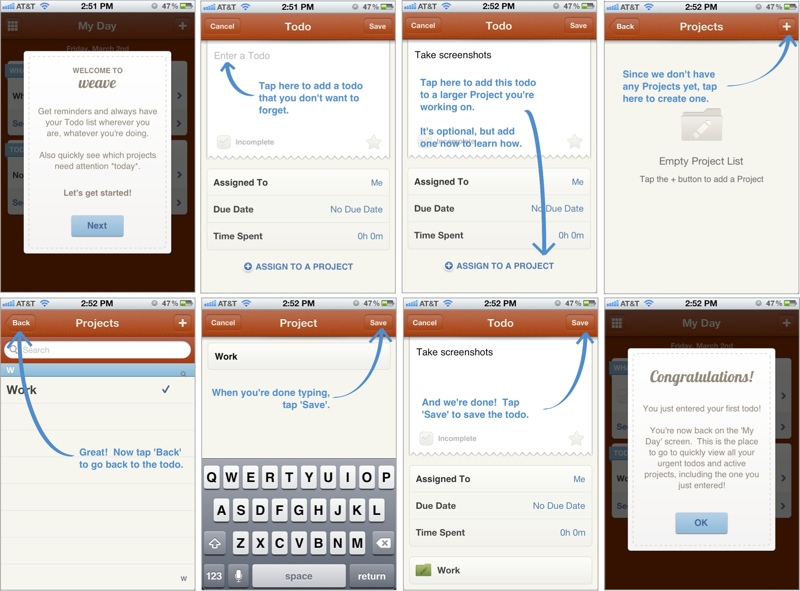

For the best chance of success, you need to identify the smallest core of your idea that has value to your potential users, build only that, and release it. This “minimum viable product” or MVP serves as the ultimate idea testing ground. It lets you build a relatively inexpensive version of your idea, test it with real users, and measure adoption.

Investors see a lot of ideas, which is why they won’t sign an NDA (your idea is not original, no matter what you think). But if you have a team that has delivered products in the past, worked through adversity, and has a failure or two to learn from, then the investor can see a group of people who will protect his investment, and has demonstrated the skills to do so.

So No. An idea will not get you funded.

To be investible, a start-up needs to have a good product-market fit and the potential to scale up quickly to a large market. It needs to be defensible with intellectual property or some other competitive advantage. And it needs to have a credible team in place, people who investors will believe can execute. And there needs to be some kind of proof, also called validation, also called traction.

Building an early prototype also helps you attract tech talent, because it gives people something to look at and play with, and it communicates your idea in a more “tangible” form. Then you can shop it around to potential technical co-founders to get them excited about your vision. If you have the means to actually build a working prototype, so much the better!

Most Angel Investors (and VCs) won’t pay much attention these days without some other sign of traction, especially because the financial and technical barriers to entry are getting lower and lower.

Additionally, the current market size doesn’t matter. The market size in 10 years is what really matters. You want to be in a small but rapidly growing market. You can change everything in your start-up except the market. So spend a lot of time up front to make sure you’ve thought through your market. “Having value” and “being fundable” are two completely different things.

Two of the most valuable things that the investor community seems to have been seeing from close quarters are: customer feedback and data from pilot research, which can enable them ask questions that lead to product breakthroughs. Angel Investors would need to know how your idea has improved to a bit more than a fledged product wireframe, so that their willingness to invest into those ideas via money, and social reach can increase to ensure that the success of your product is further defines by cutting-edge product development process.

Following guidance is thus seems to have gained ground and immovable traction for all the aspiring entrepreneurs who are progressing from a Bootstrapping channels to Angeled funding:

- Be value-driven rather than fund-driven

- Be independent of technologies that make you lose control over your idea

- Make the customer a base for your product than profit

- Base your ideas on supply and demand and not on the money it can attract

Once again, this isn’t a strict definition, but the seed round is normally used to fund the initial stage of your company where you’re finding product/market fit, and the following rounds are meant to help with scaling. That said, the road from concept to readiness (aka product MVP) is long and winding. Entrepreneurs’ single greatest challenge in this sphere of activity is balancing bursting creativity with structured, method-driven decision making.

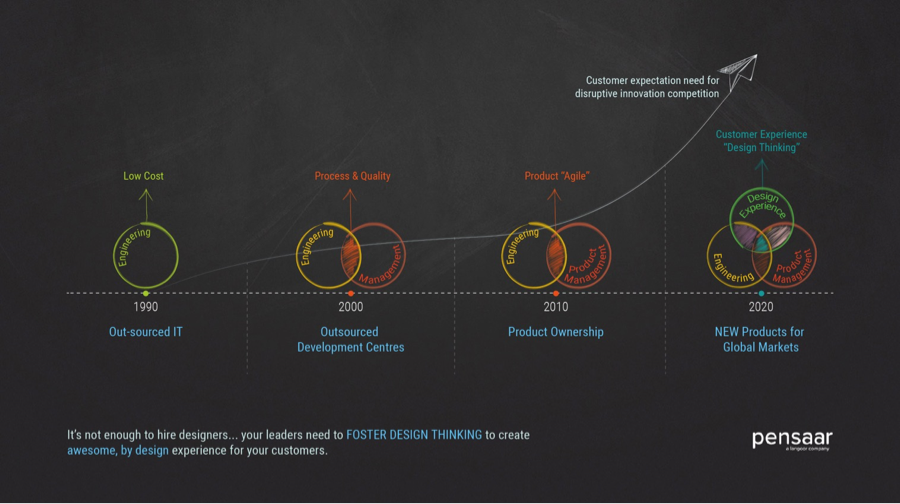

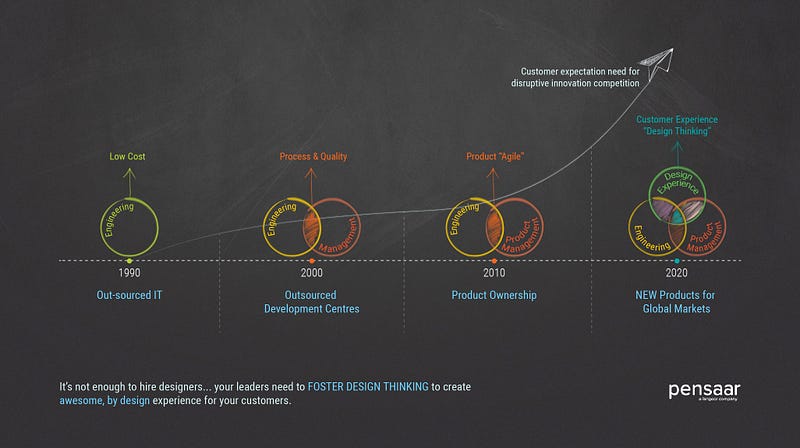

It was truly inspiring and motivating to see so many people pay it forward, we were blessed to have that kind of support. Gave us more passion and energy to realize our vision to spread the awareness and application of design thinking.

It was truly inspiring and motivating to see so many people pay it forward, we were blessed to have that kind of support. Gave us more passion and energy to realize our vision to spread the awareness and application of design thinking. ‘Preparing for glory’- Like the Spartans, Pensaar too is setting stage for the ultimate revolution. The UnConference, Phase-ll of the Design Thinking Summit is gathering traction and building from a 60+ gathering at Phase-l to now include 300+ participants.

‘Preparing for glory’- Like the Spartans, Pensaar too is setting stage for the ultimate revolution. The UnConference, Phase-ll of the Design Thinking Summit is gathering traction and building from a 60+ gathering at Phase-l to now include 300+ participants.

Not surprising that companies (of every shape, size and origin) are struggling with innovation. Good work is happening, the right interventions are being made but these interventions are happening in silos. One is left with the feeling that “some secret sauce is missing”. Is there a secret sauce? And is it missing?

Not surprising that companies (of every shape, size and origin) are struggling with innovation. Good work is happening, the right interventions are being made but these interventions are happening in silos. One is left with the feeling that “some secret sauce is missing”. Is there a secret sauce? And is it missing?

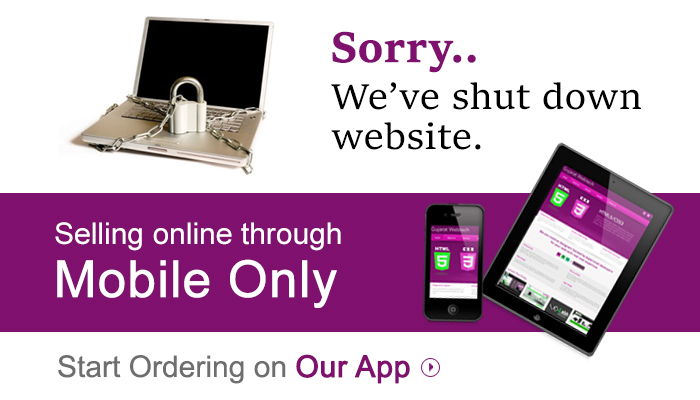

As the dog fight continues to grab market share, e-commerce players are trying to outdo one another by introducing newer business models and innovations; the latest being Mobile Only format. Though there have been many successful experiments that defined the online buying culture in India such as Cash on Delivery, easy hassle free returns and EMIs, the latest experiment’s success is not pronounced yet, while many of the digital enthusiasts are upbeat about it.

As the dog fight continues to grab market share, e-commerce players are trying to outdo one another by introducing newer business models and innovations; the latest being Mobile Only format. Though there have been many successful experiments that defined the online buying culture in India such as Cash on Delivery, easy hassle free returns and EMIs, the latest experiment’s success is not pronounced yet, while many of the digital enthusiasts are upbeat about it. Here comes the Mobile Only strategy! While all the arguments for Mobile Only strategy evangelize the potential of the native app technology and innumerable values it promises to the marketer, an honest assessment of the anticipated compromises on the side of the customer is yet to come i.e what possibilities it takes away from the customer in order to cut short longer sales cycle. Ironically, the deterrents for marketers to sell more are also the very value drivers for the consumers to buy more!

Here comes the Mobile Only strategy! While all the arguments for Mobile Only strategy evangelize the potential of the native app technology and innumerable values it promises to the marketer, an honest assessment of the anticipated compromises on the side of the customer is yet to come i.e what possibilities it takes away from the customer in order to cut short longer sales cycle. Ironically, the deterrents for marketers to sell more are also the very value drivers for the consumers to buy more!

Design to delight: Instead of Mobile only format, to fully capitalize rapidly growing net users the e-commerce players should repurpose all the touch points rather than limiting to only mobile touch points. Marketers should offer all options of net access points including web along with mobile, with all screen options and continuously reexamine the new touch points of value creation.

Design to delight: Instead of Mobile only format, to fully capitalize rapidly growing net users the e-commerce players should repurpose all the touch points rather than limiting to only mobile touch points. Marketers should offer all options of net access points including web along with mobile, with all screen options and continuously reexamine the new touch points of value creation.

As it was once said, “A creative adult is a child who has survived”. So what are you waiting for? See you on 28th Nov ’14 under the umbrella of UXnow. Let us together revisit the creative child in us in our very own NCR and we promise that you would ‘Rediscover’ the shining Nickel for the wonder inside.

As it was once said, “A creative adult is a child who has survived”. So what are you waiting for? See you on 28th Nov ’14 under the umbrella of UXnow. Let us together revisit the creative child in us in our very own NCR and we promise that you would ‘Rediscover’ the shining Nickel for the wonder inside.